Sasol confirms Rompco pipeline sale ‘well advanced’ as asset disposal process kicks into gear

Chemicals and energy group Sasol confirmed on July 1 that the sale of its equity interest in the Republic of Mozambique Pipeline Investment Company (Rompco) and the Central Termica de Ressano Garcia gas-fired power plant, also in Mozambique, were well advanced, along with partnering discussions for its base chemicals assets, in the US.

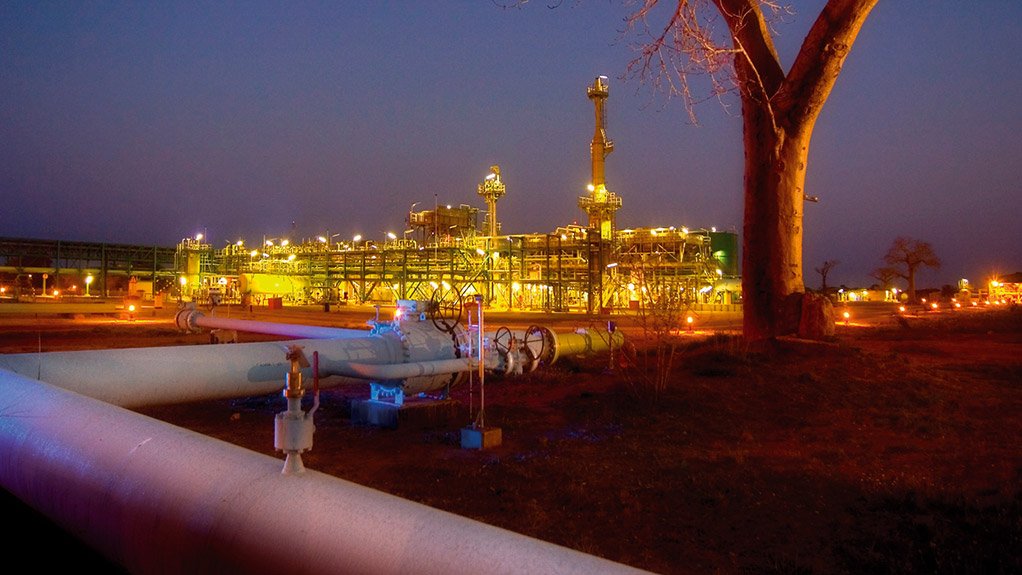

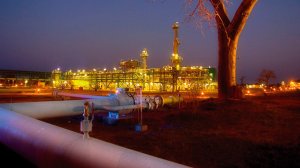

In a statement to shareholders, the JSE-listed group officially confirmed that the 865-km gas pipeline, in which it has a 50% share, would be sold.

Prior to the statement, Bloomberg reported that Sasol expected to receive binding bids within weeks for its stake in the Rompco pipeline, which transports gas from Sasol’s Pande and Temane gasfields, in southern Mozambique, to South Africa.

The other shareholders in the pipeline include the State-owned Companhia Mocambiçana de Gasoduto (25%) and the South African Gas Development Company (25%), which is also known as iGas and is a subsidiary of South Africa’s Central Energy Fund (CEF).

During a recent presentation to lawmakers, the CEF indicated that it was closely monitoring Sasol’s asset disposal process for opportunities.

Sasol also announced to shareholders on Wednesday that it had signed an agreement with Chevron for the sale of its indirect beneficial interest in the Escravos Gas to Liquids (EGTL) plant, in Nigeria.

No value was provided for the EGTL disposal, but Sasol indicated that the transaction had an agreed economic effective date of September 1, 2019.

Sasol also confirmed that Chilean explosives group Enaex had officially assumed management and operational control of a new African explosives business that incorporated Sasol’s explosives units in South Africa and the rest of Africa.

The joint venture, which began trading as Enaex Africa on July 1, is majority owned by Enaex, a subsidiary of the Sigdo Koppers Group.

The transactions signalled that Sasol’s so-called accelerated divestment programme was beginning to kick into gear.

Sasol is aiming to realise between $2- and $5-billion in proceeds from the disposals, initiated to help reduce its $10-billion debt burden by $6-billion by the end of its 2021 financial year.

Besides disposing of noncore assets, Sasol has indicated that it is considering various joint venture partnerships, including at its Lake Charles Chemicals Project, a key cause of the group’s unsustainable financial position, which had deteriorated sharply as a result of the fall in global oil prices and the Covid-19 pandemic.

Sasol had also initiated cash-conservation and cost-saving initiatives, but had indicated that it was still likely to pursue a rights issue of up to $2-billion in the coming months to shore up its financial position.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation