Plastics industry release latest recycling figures

This article has been supplied as a media statement and is not written by Creamer Media. It may be available only for a limited time on this website.

Plastics SA, the umbrella body representing the local plastics industry, has just released the official plastic recycling stats for the year ending 31 December 2020. Each year, data is collected from plastics recyclers around the country by Plastix 911 on behalf of Plastics SA. PETCO provides figures from their listed PET recyclers, whilst raw material suppliers Sasol and Safripol provide input on the production and domestic demand of plastics raw materials.

Plastic industry market sectors:

South Africa’s plastics industry is dominated by the packaging sector (which accounts for roughly 52 % of the local market), followed by building & construction (13 %), agriculture (9 %), automotive and transport applications (7 %).

Due to increased awareness of hygiene caused by the outbreak of the Covid-19 pandemic, the demand for flexible packaging increased 2 % in 2020. Demand for rigid packaging (linked to on-the-go meals, PET beverage bottles and take-away containers) shrunk, although packaging used for domestic- and personal care increased due to the greater emphasis on cleaning and the increased demand for hand sanitisers. Packaging sheeting was also used to manufacture face shields locally.

Consumption of virgin and recycled plastics in SA:

South Africa, like most countries around the world, has witnessed decline in collection and recycling rates during 2020, compared to pre-COVID-19 rates. In addition, many recyclers were unable to operate at full capacity for several months during the past year due to social distancing norms. Other factors that adversely affected the plastic recycling activities include ongoing loadshedding, water shortages and high labour costs which forced many operations to scale down, or even close their doors permanently.

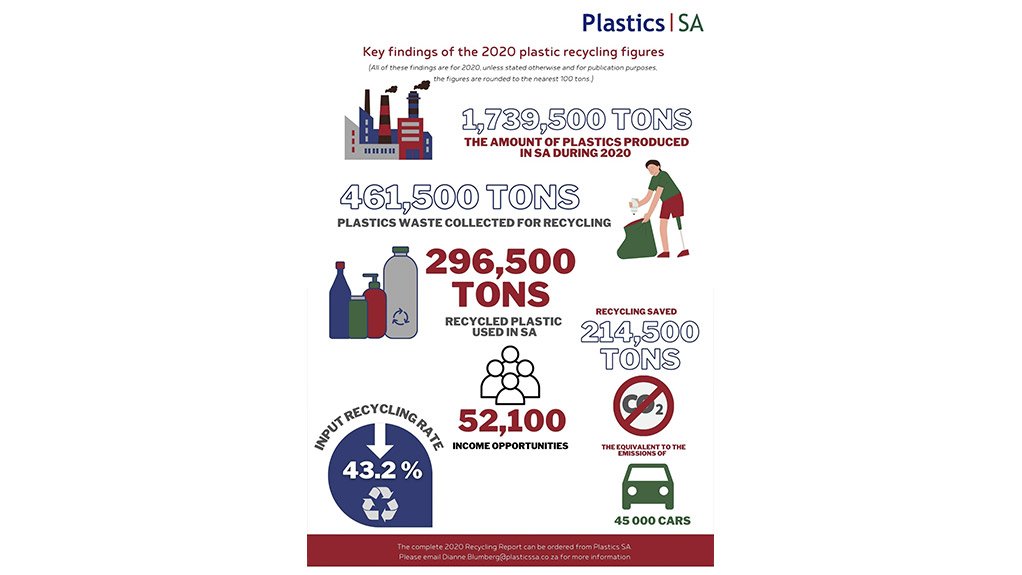

- South Africa converted 1 739 480 tons of polymer into plastics products during 2020, a decrease of 5.6 % from 2019. This is the total amount of locally produced polymers, imported polymers and recycled polymers sold to local convertors in South Africa, and excludes polymers exported, virgin and recycled.

- Locally recycled polymer represented 17 % of the total domestic consumption, a drop from 18.3 % in the previous year.

- Per capita consumption for locally converted plastics (virgin and recycled) decreased to 29 kg/person (down from 31 kg/person recorded in 2019). Per capita consumption for virgin material only, dropped from 26 kg to 24 kg. Virgin consumption increased by 11 % since 2011, whilst recycled tonnages, locally converted, increased by 35 % in the same 10 year period.

Plastic recycling in SA

South Africa recorded an input recycling rate of 43.2 % during 2020. 461 500 tons of plastic waste were collected for recycling, of which 312 600 tons were successfully recycled back into raw materials. 296 500 tons of recyclate were used to produce new products while 97 260 tons of recyclate was used to produce new packaging.

In an attempt to improve the quality of the incoming recyclables, as well as to reduce their high recycling cost due to contamination, an increasing number of recyclers have started going directly to the waste generators. This allowed them access to cleaner materials and maintain their margins, albeit at lower quantities.

- 64 % of the incoming waste came from landfill and other post-consumer sources. Of this, the majority of the volume (54 %) was sourced from the formal sector, collectors and waste management companies. Most plastics were baled, but some were also loose materials.

- 18 % of the waste was post-industrial materials, sourced from distribution centres, shopping centres, farming communities and other waste generators.

- Although very critical to the value chain, only 3.6 % of recyclables were obtained directly from waste pickers and walk-ins. A further 6 % was collected from drop-off facilities and buyback centres.

- Recycling of plastic waste saved 213 500 tons of CO2 – the equivalent to the emission generated by 45 000 cars.

End-markets for plastic recyclate

Suitable end-markets are critical for the sustainability of the plastics recycling industry. Markets for recyclate exist in most local market sectors. Only 5.2 % of the recyclate was exported as raw material to plastics convertors in the SADC region and Asia.

- Brand owners and retailers have committed to recycled content in packaging. Although currently, only recycled PET (rPET) is suitable for food contact applications, recycled PP, PE-LD and PE-HD are used in non-food applications, e.g. personal- and domestic care packaging.

- Recycled flexible packaging was the largest market for recyclate in 2020. 22 % of all recycled materials were used to manufacture products such as shopping bags, refuse bags and general flexible packaging.

- Agricultural applications making use of recycled plastics accounted for 14 % of the market, ranging from irrigation pipes, rotational moulded tanks and borehole liners to animal feeding- and water troughs.

- Other major markets for recycled plastics in South Africa include clothing and footwear (14%) and the building and construction market sectors (12 %), e.g. builders’ film, geotextiles and composite building panels.

Conclusion

Over the last century, plastics have offered innovative solutions to society’s permanently evolving needs and challenges. Versatile, durable, and incredibly adaptable, plastics are a family of remarkable materials with science and innovation in their DNA. Nowadays, they allow us to meet a myriad of functional and aesthetic demands, from drinking clean water, playing sport, staying connected, enjoying the comfort of home and the efficiency of clean mobility, to helping us to live longer and healthier lives

Plastics can be re-used and refilled, recycled and finally, the captured energy can be recovered when it can no longer be re-used. However, it is of vital importance to ensure that all stakeholders in the value chain collaborate and co-design sustainable product management principles, over the full value chain, that will ensure a complete circular life cycle for plastics.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation