Compelling Makhado first phase has rapid return promise – MC Mining

MC Mining CEO David Brown talks to Mining Weekly Online’s Martin Creamer. Photographs: Dylan Slater. Video: Kutlwano Matlala. Video Editing: Nicholas Boyd

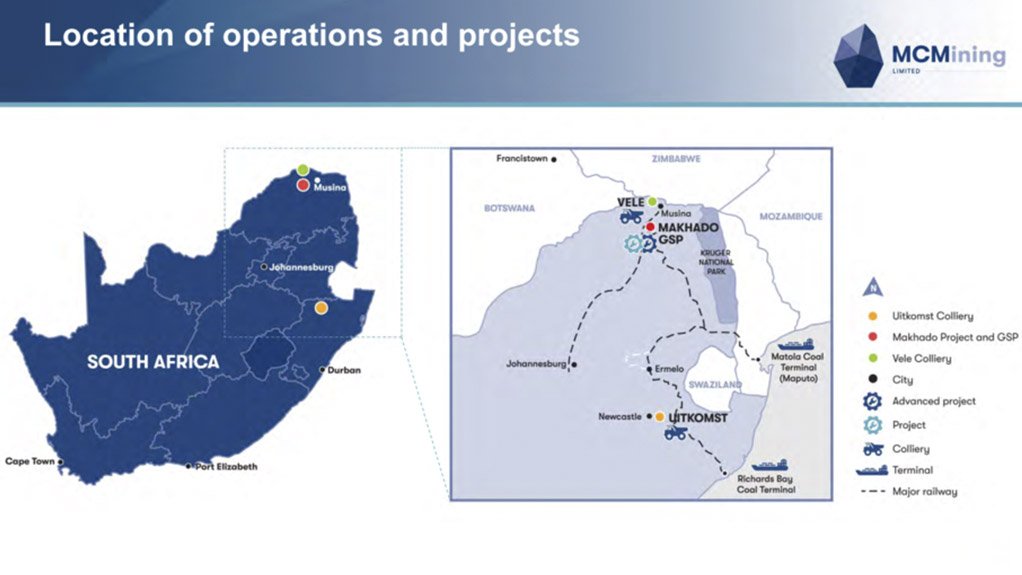

The location of MC Mining operations and projects.

Photo by MC MINING

JOHANNESBURG (miningweekly.com) – Hard coking coal and thermal coal producer MC Mining, which was successful in securing the Industrial Development Corporation (IDC) credit-approved facility of $17-million in July, is looking to raise $52-million to fund the first phase of the Makhado hard coking coal project as well as repay the current IDC loan.

Alternative funding mechanisms are being pursued for Makhado’s overwhelmingly derisked first phase, which has firm offtake agreements in place and prompt payback in sight. (Also watch attached Creamer Media video.)

By differentiating itself as a metallurgical coal producer, MC Mining has managed to see off the current negativity around thermal coal.

The first phase of Makhado, which benefits from built and paid-for processing infrastructure at the shut Vele mine, is scheduled to be built in nine months and the first coal sold ten months after construction begins.

Offtake agreements have already been secured for 85% of the hard coking coal from the first phase and 100% of the thermal coal by-product.

“We’re confident that we’ll get Makhado Phase 1 away because it’s a very good project. Payback’s less than three years based on our long-term view of pricing. So, given that, I think the economics of the project are very compelling and very good,” MC Mining CEO David Brown said in response to questions put by Mining Weekly Online.

Even though coking coal prices have declined in the last couple of months, the general consensus is that long-term fundamentals will reassert themselves on pricing going forward.

“Overall, the project for us is a good one, it’s a positive one, well capexed, quick into production and quick payback. I think it would make for a very good project and so we’re confident that we should get the money. I think that the issue really is just timing,” Brown said.

The plan is for entry into the second phase of the project being accompanied by an intensive study of the coking-coal-endowed region’s 100-year opportunity that is expected to be enhanced by the declaration of a coal-using regional special economic zone (SEZ) involving a cooperation agreement between the South African government and China.

“But our real focus at the moment is to look at Makhado Phase 1, get the funding for that, get that constructed and up and going. That will take us towards the backend of calendar year 2020 and with real concentration on the other opportunities starting in the 2021 year and going forward from there,” added Brown.

Key to Makhado and parts of Chapudi is offtake by ArcelorMittal South Africa (AMSA) plus export to other steel mills around the world, and key to Vele and Mopane is offtake by the SEZ at Musina.

MC Mining has secured the mining rights and the surface rights over all the four properties required for the first and second phases of the Makhado project, which will set the company on its way to becoming the pre-eminent producer of hard coking coal, which is currently not produced in South Africa.

AMSA will take the bulk of the hard coking coal for local steel production.

Even more important than the balance-of-payments saving is that the project will bring economic relief to an under-employed area, additional procurement opportunities for local suppliers of goods and services as well as equity ownership for local communities.

Generally, the price of hard coking coal is 150% to at times 200% higher than the price of thermal, which explains MC Mining’s targeting of it.

On Makhado’s funding, Brown told Mining Weekly Online: “We’re looking for a combination of debt and equity funding. Essentially, the IDC provides us with the debt funding aspect of it. We’re looking for some equity funding and we’re looking at various options, whether it be listed company equity involvement or whether it be at the underlying project company as well. We’re looking at a combination potentially of both of those, but we are working on a number of initiatives at this point in time,” he said.

As Vele’s operating plant will be used, Makhado’s Phase 1 has the benefit of being a brownfield modification that lowers capital expenditure significantly.

“Phase 1’s capital expenditure is around about $30-million, depending on which rand-dollar exchange rate is used, but probably give or take $30-million,” Brown explained.

UITKOMST COAL MINE

MC Mining, which had some production output difficulties at the Uitkomst coal mine over the last 12 months, is benefitting from more predictable production output currently. The metallurgical coal product produced at Uitkomst is sold to AMSA.

“I think we’ll get the production profile in line with what we anticipate. Obviously, we don’t have control over pricing but we’re looking forward to pricing improving, even for thermal coal, over the next 12 to 18 months.

“We’re viewing thermal coal as a by-product, very much as a contribution to overhead costs. Our predominant feature will be being a hard coking coal producer and the revenue and profits will be quite significantly weighted towards hard coking coal; well over 60% to 70% will be hard coking coal weighted. So, we are leaning very heavily towards the steel production space.

The fact that 85% and not 100% of the first-phase output is spoken for is a bonus because it will allow MC Mining to prove to other steelmakers around the world that it has a superior product, which will potentially increase its customer base as it lines up Phase 2.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation