Risk Mitigation Independent Power Producer Procurement Programme, South Africa – update

Name of the Project

Risk Mitigation Independent Power Producer Procurement Programme (RMIPPPP).

Location

South Africa.

Project Owner/s

Department of Mineral Resources and Energy (DMRE).

Project Description

The RMIPPPP, which is also known as the ‘emergency’ procurement round, is a response to the short-term electricity supply gap identified in the Integrated Resource Plan 2019.

The objective of the RMIPPPP is not only to alleviate the current electricity supply constraints but also reduce the use of diesel-based peaking electrical generators.

The programme aims to procure 2 000 MW from a range of energy sources and technologies.

The DMRE issued a request for proposal for the RMIPPPP in August 2020.

Mineral Resources and Energy Minister Gwede Mantashe released the names of the eight preferred bidders on March 18, 2021:

- the 150 MW ACWA Power Project DAO – a hybrid facility comprising solar photovoltaic (PV) and a battery energy storage system (BESS);

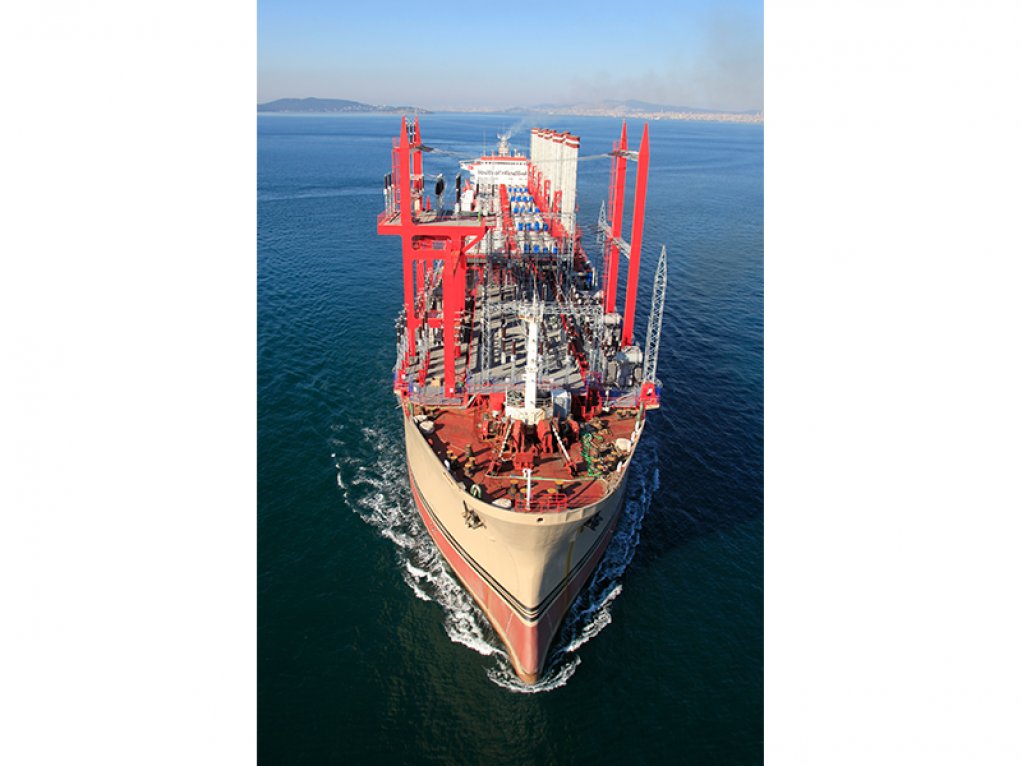

- a 450 MW Karpowership SA Coega facility – a gas-to-power plant based on imported liquefied natural gas (LNG);

- the 450 MW Karpowership SA Richards Bay facility – a gas-to-power plant based on imported LNG;

- a 320 MW Karpowership SA Saldanha facility – a gas-to-power plant based on imported LNG;

- the 198 MW Mulilo Total Coega facility – a hybrid plant employing solar PV and imported LNG;

- the 75 MW Mulilo Total Hydra Storage project – a hybrid facility comprising solar PV and a BESS;

- the 128 MW Oya Energy Hybrid Facility – a hybrid facility comprising solar PV, wind and a BESS; and

- the 75 MW Umoyilanga Energy – a hybrid facility comprising solar PV, wind and a BESS.

Eligible bids, with a combined capacity of 150 MW, could still be awarded under the RMIPPPP at a later stage, subject to a value-for-money reassessment.

The projects will include average local content of 50% during construction, South African entity participation of 51% and black ownership of 41%.

Potential Job Creation

Not stated.

Capital Expenditure

The combined investment value of the eight projects is estimated at R45-billion.

Planned Start/End Date

The projects are expected to reach financial close by no later than the end of July 2021 and be connected to the grid from August 2022.

Latest Developments

Civil society organisations are supporting calls by Parliament for public hearings into the decision by the DMRE to include projects by Karpowership among the preferred bidders for the RMIPPPP.

Environmental justice organisation the Green Connection says it has been very vocal, adding its voice to the public outcry, amid concerns about the choice of emergency power, which will result in South Africa being tied to fossil fuels for another 20 years. Several other organisations and institutions have echoed Green Connections’ concerns.

The Portfolio Committee on Mineral Resources and Energy are expected to continue its deliberations on the issue, having raised several concerns about the scheme during a DMRE briefing on April 20.

Chairperson Sahlulele Luzipo has said it is clear that the committee members remain “too far from one another” on the issues, but has refused to be drawn on whether it might recommend public hearings on the matter, emphasising that he does not want to influence the deliberations.

He has also raised concern about a lack of knowledge domestically about the costs and benefits of the three floating gas-fired power stations named as preferred bidders, describing the power ships as a “new phenomenon” about which more information is required.

In addition, the power ships require Transnet National Ports Authority and South African Maritime Safety Authority permits, as they would be docked in the ports for two decades.

DMRE deputy director-general Jacob Mbele has said that no PPA will be concluded unless all the requirements, as set out in the request for proposal, have been fulfilled, including securing all authorisations and permits.

Mbele has emphasised that the design of the RMIPPPP is in line with technical specification by the System Operator, or Eskom, and aligned with the Integrated Resource Plan of 2019.

Meanwhile, energy consultant Clyde Mallinson has written to the Department of Public Works and Infrastructure (DPWI) and the Independent Power Producer (IPP) Office to highlight the expensive shortcomings of the RMIPPPP, which he says should be replaced by a materially larger, yet more cost-effective, procurement programme based primarily on renewables and storage, rather than power ships.

The DPWI, together with The Presidency, is overseeing the implementation of the Strategic Infrastructure Projects, or SIPS, earmarked for priority implementation as part of government’s economic recovery from the Covid-19 pandemic. The RMIPPPP is one of the 62 initial SIPS gazetted in line with the Infrastructure Development Act.

Mallinson warned ahead of the December RMIPPPP bid deadline in October 2021 that the rules treating every project as separate generation “islands” were heavily skewed in favour of gas-to-power solutions and would result in extremely costly bids.

He said the standalone architecture, which made it impossible for projects to tap into existing grid infrastructure to help reduce the cost of production, should be overhauled to avoid an outcome that would lock in “dirty and expensive energy for the next 20 years”.

Mallinson has also questioned why government is targeting to procure only 2 000 MW in a context where the true deficit is far bigger. It has been estimated at 5 000 MW by Eskom.

In his briefing note sent to the IPP Office, Mallinson argues that a “systems” response that deploys all the country’s existing electricity assets will be a far cheaper way of responding to the electricity emergency than the RMIPPPP.

Such an approach would allow for new projects to interact with the country’s existing generation, storage, transmission and distribution infrastructure to unlock “complementary or mutually beneficial interaction”.

This full systems approach allows for 30 TWh/y or more to be procured at an estimated tariff of R0.61/kWh, or 39% of the weighted average tariff (R1.58/kWh) of the winning bids in the RMIPPPP.

“Importantly, 10 TWh of the 30 TWh, or the equivalent of the output of the RMIPPPP, will meet all the requirements of the RMIPPPP, and guaranteed dispatchable supply of 2 000 MW from 05h00 to 21h30 will be available, each and every day of the year,” the note reads.

Achieving such an outcome would involve the IPP Office immediately procuring or allowing for the commercial procurement of 5 GW of solar PV, 3 GW of wind and 2 GW/4 GWh of storage.

“For a commitment of an additional 15% of National Treasury-backed power purchase agreements (PPAs), Eskom will be able to procure three times as much electricity, at 39% of the cost/kWh, compared with that offered by the RMIPPPP,” Mallinson contends.

In addition, he calculates a fourfold increase in infrastructure spend and a tenfold increase in job creation, aligned with government’s aim of using infrastructure to reignite economic growth, which slumped 7% in 2020 because of the Covid-19 pandemic.

“The estimated local infrastructure spend of the alternative 30 TWh systems approach is about R95-billion.”

It would also eliminate fuel-price-volatility risk assumed under the RMIPPPP, owing to gas being treated as a pass-through cost.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

DMRE, Natie Shabangu, email natie.shabangu@dmre.gov.za; or Thandiwe Maimane, email thandiwe.maimane@dmre.gov.za.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation