Industrial policy changes needed, TIPS forum hears

Academics and researchers have highlighted some of the policy changes needed within a changing global economy during economic research nonprofit institution Trade & Industrial Policy Strategies’ (TIPS’s) yearly forum.

Management consultancy firm RB Africa director Odwa Mtati told delegates that the contribution of small and medium-sized enterprises (SMEs) to manufacturing production and reindustrialisation could only be achieved if the broader economy was growing.

The contribution of manufacturing to gross domestic product (GDP) had fallen from 30% in 2011 to 11.3% in 2022, while the contribution of SMEs to total manufacturing turnover has grown from below 40% in 2008 to 53% in the fourth quarter of 2022.

Additionally, the number of people employed in the manufacturing sector declined from about 1.6-million in 2008 to about 733 000 in 2022, which is a 37% decline, despite the increase in output from manufacturing SMEs, he said.

Further, a study by developed economies bloc the Organisation for Economic Cooperation and Development found that small established businesses with fewer than 100 employees account for 40% to 80% of manufacturing employment internationally and present a higher net job creation rate than larger organisations.

As part of Mtati's study of the drivers of and lessons from the decline in SMEs in manufacturing, he compared South Africa with Malaysia, Vietnam and the Philippines.

The contribution of manufacturing SMEs to the GDP of Vietnam rose to 24.8% in 2022 from 18.6% in 2008, while in Malaysia, manufacturing SMEs contributed 24.5% in 2008 and also in 2022, but there was a decline and recovery during this time.

In the Philippines, similar to South Africa, the contribution of manufacturing SMEs to the country's GDP declined to 17% in 2022 from 23% in 2008.

"The policies in these countries are similar to those promulgated in South Africa over the years. The Vietnam government has adopted a national development plan setting out its aims to 2045, which has a particular focus on supportive measures for SMEs, as well as specifically domestic industrial enterprises.

"Malaysia adopted measures that are focused on SMEs particularly in higher manufacturing value chains, as well as the modernisation and digital transformation of manufacturing SMEs, and supporting the adoption of technologies and product development.

"Further, Malaysia also has a focus on strengthening the financial capabilities of the entrepreneurs in SMEs, as well as a procurement initiative to connect SMEs to those they supply and increase demand for their products," he said.

"The main recommendation from the study is to grow the inclusion of SMEs in the value chains of large businesses and to promote cooperation between large and small businesses," Mtati said.

CHANGING SUPPLY CHAINS

Meanwhile, University of Cape Town Nelson Mandela School of Public Governance research fellow Vuyiswa Mkhabela detailed some of the changes in sourcing by clothing retailers and the impact on clothing and textile manufacturing in the country.

From 1995 to 2001, retailers offshored their clothing sourcing to China. Local manufacturers did not have enough orders to sustain operations, which led to job losses and factory closures, and the lack of reinvestment in productive capacity further contributed to the downward spiral.

"From 2007 to 2008, the government implemented a two-year period that applied quotas to Chinese imports. However, retailers adjusted and sourced from other regions and there was no decrease in imports as retailers diversified their sourcing.

"Manufacturing competitiveness is not helped by trade policies unless these are paired with policies that can help manufacturers become more competitive," she said.

However, the diversification of retailers' supply chains not only included offshore sources, but also near-shore sources. Retailers sourced clothing from Southern African countries that had built up productive capacity to participate in the US African Growth and Opportunity Act.

South African retailers sourced clothing and textiles from Mauritius and eSwatini that were exported to South Africa. The demands from US buyers on suppliers meant that the products were of high standards and that the suppliers built up their capabilities.

South African retailers take advantage of the capabilities built up under preferential trade agreements in other regional countries.

Another factor influencing changing sourcing trends is the shift by retail chains to a quick-response model. The aim is to respond quickly to customer needs and meeting demand requires retailers to have access to suppliers closer to their home market.

Retailers are also looking to diversify supply chains to mitigate risks and uncertainty and are looking to expand stores in the Southern Africa region. While retailers sourced mainly from East Asia between 2015 and 2019, Southern African sourcing is on a steady increase, said Mkhabela.

There have been some discussions with governments about the role retailers play in sourcing from local suppliers. During the 1990s and 2000s, industrial policy linked to clothing retail supply chains was reactive.

The clothing and textile competitiveness programme in 2010 included incentives to increase competitiveness and support the improvement of productive capabilities through new machinery and capital equipment. The more recent master plan aims to increase local demand and sourcing, she noted.

"Any policy consideration around reshoring and near-shoring is that it must make commercial sense for suppliers and buyers, and there are some constraints and tensions between local and regional sourcing.

"The crucial missing middle element is textile production. We need to support and encourage investment, skills development and technology deployment, as well as research and development across segments of the value chain from fabric to apparel.

"However, the main focus should be on textile production and industrial policies should be based on global trends to ensure that they are forward-looking and support the sustainability shift to new fibres and the technologies required to produce those," Mkhabela highlighted.

Further, countries in the region should link inward domestic policies with regional policies to focus on how regional production chains can be created. This can create an ecosystem of regional technology hubs and centres of excellence.

Industrial policies should look to connect retailers with suppliers by mapping out regional capabilities and identifying opportunities for local and regional sourcing, she said.

MINERALS-LED DEVELOPMENT

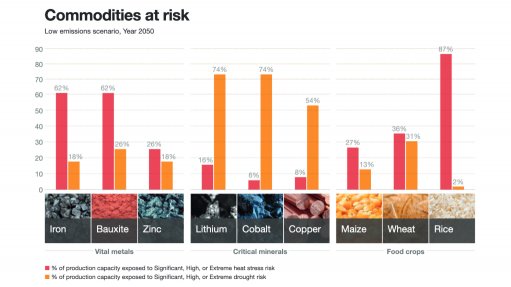

Additionally, the global green energy transition is set to be minerals-intensive and Africa is well endowed with most of the critical energy minerals, said University of Johannesburg Centre for Competition, Regulation and Economic Development senior researcher Elvis Avenyo.

"African countries can take advantage of the transition to green production processes to transition to medium- and higher-value chains by implementing minerals-led industrial strategies," he said.

However, while Sweden, for instance, used its mineral resources to industrialise, many African countries were not able to follow this development trajectory, with mineral resources contributing to wars and higher levels of impoverishment.

Africa is well integrated with global value chains, but the majority of processing of the minerals takes place outside the continent, he noted.

However, with concerns mounting about the concentration of processing of minerals in the global trade environment, there is an opportunity for Africa to strategically build global alliances that are in the interest of the continent.

Countries that have the requisite productive capabilities and foundations to develop elements of the value chains can leverage the drive to diversify energy minerals value chains.

However, even if countries could not process minerals within their borders, regional value chains and a larger market across Africa could serve as key drivers to translate some of the minerals present into products and development, said Avenyo.

Further, African countries can use their minerals to diversify production processes in other areas, such as supporting agricultural value chains and the production of biofuels. Some of these interlinkages between different industries can multiply the effect in several ways of leveraging beneficiation activities to create more diverse industries on the continent.

"Africa has a key role to play in the global energy transition, and there are lots of opportunities and challenges ahead," he said.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation