Building activity boosted by office conversions – economist

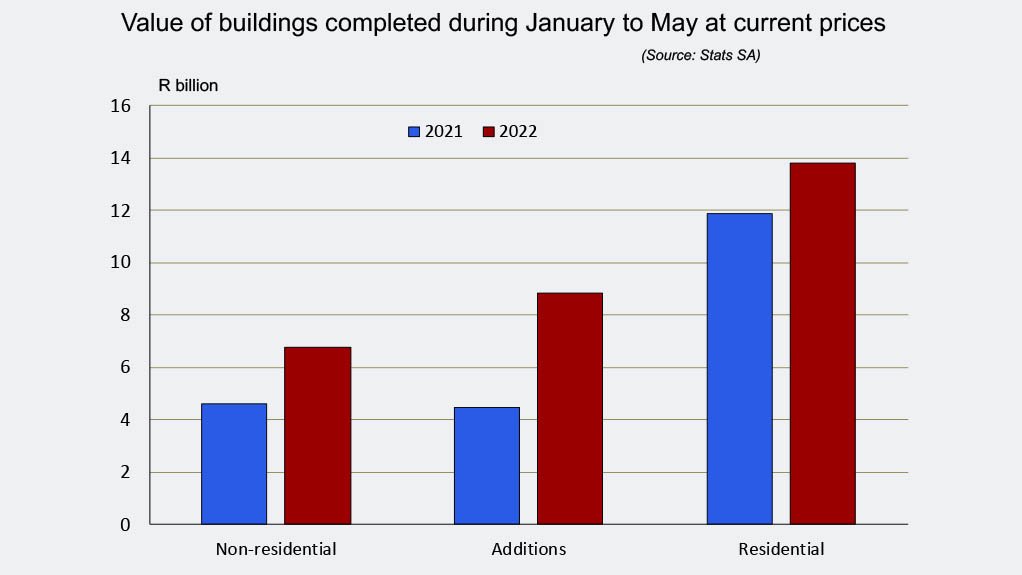

The first five months of the year have seen a “remarkable improvement” in the value of buildings completed in the metros and larger municipalities, with the category for additions and alterations coming out on top in terms of year-on-year growth rate, at “a whopping 92%”, says Optimum Investment Group economic adviser Dr Roelof Botha.

Although the value of residential buildings completed only rose by 16% year-on-year, this growth remains impressive, as it was generated from a high base, he adds.

The category for non-residential buildings placed in between these two, with a growth rate of almost 50% compared with the first five months of 2021.

The exceptionally strong showing of additions to existing buildings can be linked to the after-effects of the Covid pandemic, which has led to a structural decline in the occupancy levels of many office apartments, says Botha.

Some of these offices are now being converted into residential units or multipurpose real estate, which could include a mix of commercial, hospitality and warehousing facilities.

“It is worth noting that additions and alterations to existing buildings have now overtaken non-residential buildings as the second most important category,” notes Botha.

“This type of construction activity is inherently more labour intensive than non-residential buildings and also allows for a significant participation rate of relatively smaller firms.”

REITs Recovering

Several real estate investment trusts (Reits) will be buoyed by these newest trends, says Botha, with non-residential properties still feeling the pinch of lower occupancy rates induced by the Covid pandemic.

Although the listed property sector has outperformed the JSE all-share index over the past year, its five-year performance remains in the red.

According to news publication Moneyweb, a resumption of dividend payments by most Reits has improved investor confidence in the sector, with most fund managers forecasting forward dividend yields of close to 10%.

The pandemic has given rise to a structural shift in working conditions, with a large measure of remote work here to stay.

This will continue to shape the future performance of the property sector, especially with regard to an increase in demand for logistics space and repurposing of existing commercial and residential buildings, says Botha.

The revival of building activity is aligned to the results of the latest Afrimat Construction Index (ACI), which outperformed the gross domestic growth rate during the first quarter of the year on a year-on-year basis, albeit marginally.

The recovery of the property market from the debilitating effects of the pandemic is also reflected in the latest TPN Rental Monitor, which showed an improvement in the national residential vacancy rate from 13.3% in the first quarter of 2021, to 8.3% in the first quarter of 2022.

Rental Tenants Under Pressure

Unfortunately, tenants are facing pressure as a result of higher inflation and higher interest rates, with the number of tenants in good standing dropping marginally from 81.4% in the fourth quarter of 2021, to 80.8% in the first quarter of 2022, notes Botha.

Tenants in the R3 000 to R7 000 rental price bracket and those paying less than R3 000 a month were the worst performing categories, but rental brackets above R7 000 continued to rise from the low point recorded in the second quarter of 2020.

The Western Cape currently has the lowest vacancy rate and the highest number of tenants in good standing, says Botha.

“The province’s superior property market performance is also evident in the fact that it has overtaken Gauteng as the province with the highest value of building plans passed.

“These data sets confirm the so-called semigration trend that has become prevalent in South Africa, mainly as a result of huge and visible regional differences in the standards of service delivery at municipal level.”

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation