Opinion: Focus on improving EAF as a quick win to stop loadshedding

In this opinion article, SANEDI CEO Dr Zwanani Titus Mathe interrogates measures and interventions that could be pursued to improve the energy availability factor of the Eskom coal fleet so as to address intensifying loadshedding.

Introduction

There is no doubt that the future of electricity generation will be largely renewable energy and possibly nuclear energy. However, in the short to medium term the South African electricity grid will be largely powered by coal-based electricity generation. The Integrated Resource Plan (IRP) of 2019 captures the roadmap and policy direction adopted by South Africa. A lot has changed since 2019, and hence the IRP 2019 is being reviewed. To name a few changes in the assumptions made in 2019: it was assumed that the Eskom fleet Energy Availability Factor (EAF) would be maintained above 70% whereas today it is consistently below 60%; renewable energy costs have come down substantially, but there is a need to consider the cost of introducing large energy storage systems to support grid stability and make up for the performance of intermittent/variable renewable energy.

In addition, future updates of the IRP would have to take into account the changing characteristics of the power system, mainly due to introduction of renewable energy and energy storage systems. Besides modelling for EAF and power generation in MegaWatts (MW), the issues of power system grid stability and location of new plants/facilities would have to be taken into account. Getting the IRP 2019 reviewed, consulted and approved will take time. Meanwhile urgent steps need to be taken to address the loadshedding and baseload crisis. Some have argued that South Africa has enough capacity to cater for the current demand (and that is true when considering Eskom’s installed nominal capacity); however the low EAF evidently shows that even with sufficient installed capacity, security of supply is threatened if plant performance is poor.

According to the latest system update report from Eskom (Week 52: https://www.eskom.co.za/eskom-divisions/tx/system-adequacy-reports/), the South African electricity grid has about 55.4 GW of installed electricity supply capacity, excluding demand side products or instruments. This is broken down as follows:

- Dispatchable capacity (including imports and emergency generation resources) – 49.2 GW

- Solar PV (non-dispatchable) – 2.3 GW

- CSP (non-dispatchable) – 0.5 GW

- Wind (non-dispatchable) – 3.4 GW

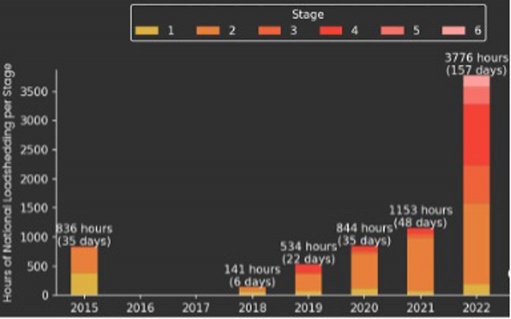

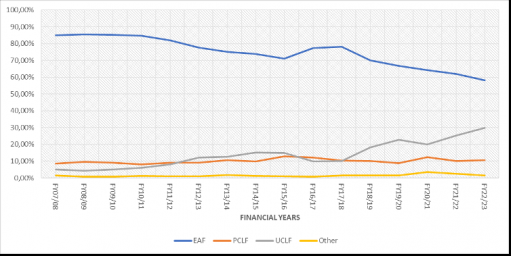

The highest peak demand in 2022 was 31.8 GW which was recorded on the 2nd of June 2022. For the rest of the year 2022, the peak demand ranged between 23 GW and 26 GW. Therefore, the electricity system in South Africa has enough installed capacity to cater for the demand, operating reserves and maintenance (planned and unplanned outages). So the big question is what has happened, from a technical point of view, that led to frequent loadshedding in 2022 as depicted in Figure 1 below? What is behind the sharp increase in Unplanned Capacity Loss Factor (UCLF) and the drastic drop in EAF as depicted in Figure 2 below?

Figure 1: Loadshedding statistics from January 2015 to December 2022 (source: EskomSePush)

Figure 2: Technical performance of Eskom Generation fleet from FY 2007/8 to FY 2022/23 (data source: Eskom)

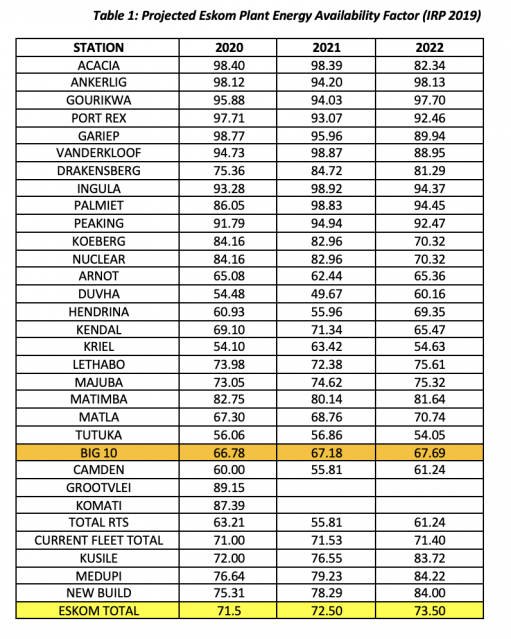

The assumptions and projections for EAF as per IRP 2019 bear reference (see Table 1 below). It was projected that EAF would be at 73.5% in 2022. Surprisingly the actual EAF as of December 2022 was 58% (per the Eskom Weekly System Status Report 2022, week 52). It is acknowledged that Eskom has had a number of non-technical challenges over the last 10 years or so, including allegations of corruption and criminal activities. However, there are technical issues that must have contributed to this sudden drop in EAF and these are unpacked below.

What happened in the recent past?

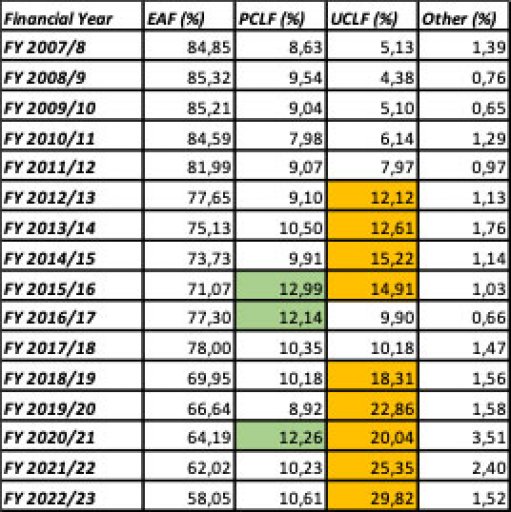

To understand what has happened in the recent past, one has to look at the EAF trend since 2008, when loadshedding started (see Table 2 below and Figure 2 above).

Table 2: Technical performance of Generation fleet (source: Eskom Audited Annual Reports and System Status Report for Week 52; Note FY22/23 is from Jan 2022 to Dec 2022)

The above table clearly demonstrates that the problem of increased plant breakdowns started around 2013, indicated by a sudden increase of UCLF from 7.97% in 2012 to 12.12% in 2013. The UCLF worsened in 2014 and 2015, with figures of 12.61% and 15.22%, respectively. To address this negative trend in UCLF, it appears that PCLF was ramped up in 2016 and 2017, as can be seen from the figures of 12.99% and 12.14%, respectively. The result of this increase in PCLF was observed in the drop of UCLF in 2017 to 9.9% from the previous high UCLF observed in 2013 (12.12%), 2014 (12.61%), 2015 (15.22%) and 2016 (14.91%). Unfortunately, the high PCLF was not maintained in 2018, 2019 and 2020. It is only in 2021 that the PCLF starts to increase to 12.26% (perhaps as a reaction to the catastrophic worsening of UCLF to nearly 23% in FY19/20). For the year 2022, the PCLF was again dropped to 10.23. UCLF averaged around 25.35% for 2022. For the current financial year FY22/23 the EAF is at 58% and UCLF at 29.82, which is the worst performance in the history of Eskom. In my humble opinion, the reduction in the PCLF is the main root cause of the current challenges Eskom is facing today regarding loadshedding. It is common knowledge that when you are operating an old fleet, maintenance is typically higher than when operating a relatively new fleet of assets. It is puzzling how Eskom got this wrong!

Furthermore, it would also appear that the effectiveness of the maintenance that is being done is not great. This observation is borne out by the fact that the PCLF bump of 12.26% has had no effect in even arresting (let alone reversing the trend) in the UCLF deterioration seen in subsequent years. This is an ominous sign that seems to indicate that we have officially arrived at that place known as being between a rock and a hard place! At face value, this seems to suggest that plant condition has deteriorated so badly, that it will require a step change in PCLF (removing substantial amount of capacity for maintenance) for quite some time in order to catch up will all the maintenance required to restore plant condition to a relatively good state. Of course, this will also require painstaking attention to the quality and priorities of the maintenance.

As a result of inadequate plant maintenance, generation is also now incurring a daily average of about 5000MW to 7000MW of partial load losses. Common problematic plant areas across the fleet include the following: Milling plant due to poor coal quality, Gas cleaning, Draught Group, Poor condensing due to poor vacuum (caused by hot air in summer and cooling water system blockages in condensing pipelines that has a negative impact on effective heat transfer and cooling water temperatures), Air heaters and High stack emissions. In addition, Station Demineralised Water Chemistry consumption is above target due to plant leaks. High demineralised water consumption places an unsustainable burden on the Water Treatment Plant to produce sufficient demineralised water to satisfy the station demand, resulting in chemical excursions (and further knock-on effects of plant deterioration!).

Furthermore, again due to inadequate maintenance of the plant, emissions performance has deteriorated. Load is sometimes curtailed to ensure that Minimum Emissions Standard (MES) limits are met or not substantially exceeded. This requires the plant to be operated under abnormal conditions or reduced load, which sometimes requires manual operating interventions. As a result dust and ash handling plants experience challenges associated with hoppers not emptied timeously and abatement control plant being damaged. This mode of operation also results in Fabric Filter Plant System (FFPS) and Electrostatic Precipitators (ESPs) facing issues of blinding of Fabric Filter Plant (FFP) bags, contamination of the ESP fields due to Fuel Oil/Unburnt carbon carry over.

Approximately half of these partial load losses can be cleared online or during weekend maintenance opportunity, provided spares and contracts are in place. The rest (approximately 3000MW) require extended outages to clear or plant modifications. With increased focus and commitment, it is possible to lower partial load losses to be consistently below 5000MW within 6 months, and thereafter to be consistently below 4000MW within 12 months. This focus and commitment is currently a challenge and most stations’ resources are consumed with fire fighting to keep the units running. In order to ensure drastic reduction of partial load losses, a different approach to what has been done previously is required. Attending to partial load losses at the coal face is required, as opposed to tracking and reporting.

Of course, there are other contributory factors that must also be considered, such as leadership that may not be equal to the task, exodus of technical skills, corruption, criminal activities at the power stations, coal quality issues, staff morale, among others.

Urgent steps to be taken

Now that the main root cause that led to excessive loadshedding has been established, what urgent steps need to be taken to turn things around reasonably quickly? The following nine (9) urgent steps are proposed:

- The President of South Africa to immediately declare a National State of Disaster for Electricity Supply empowering Eskom and government to take extra ordinary measures to stop loadshedding. This may include quick procurement of critical spares from around the world. The state of disaster would also enable mobilisation of support from other power utilities around the world. A National Electricity Supply Command Council to be set up to provide oversight.

- Eskom EXCO to urgently approve and release a maintenance budget per power station for the next 5 years. This maintenance budget must be aligned with a high PCLF (15%, but preferably much more). To accommodate this high PCLF, loadshedding at about Stage 3 level, may have to be implemented for up to 12 months. This is to allow for units to be taken off the system for general overhaul and much needed refurbishments. This approach will require an agile procurement process to allow for quick procurement of critical spares and maintenance crew. What is untenable, at this stage, is for the country to be subjected to severe loadshedding that goes on without addressing (or even allowing a worsening of) the underlying root-causes of capacity shortage, just to manage from one crisis to the next.

- Outsource maintenance to Original Equipment Manufacturers (OEMs) using risk-benefit type of long-term contracts (minimum 10 years). This must be accompanied by proper scoping of the outages, making sure critical spares are available before breaker open, and ensuring acceptable quality of workmanship during an outage. OEMs to be held accountable for outage slips and unit performance beyond the outage. If the outage slips or unit trips occur after returning from an outage or a unit breaks down due to poor workmanship post-outage, the OEM must face economic penalties for each hour of downtime or load loss. Having a well-defined system of holding OEMs accountable for plant performance, and the consequences that goes with it, will compel the OEMs to have the right skills in place and ensure high quality of workmanship. By the same token, if the unit performs well after an outage, the OEM and staff must be rewarded.

- Establish site-based recovery teams for plant maintenance oversight (made up of Eskom specialists and Independent Specialist Engineering Companies), reporting directly to the Power Station Manager. The site-based maintenance recovery teams must be empowered to make decisions without having to write endless memorandums and motivations to head office managers and committees. The Power Station Manager must be the final decision maker during this recovery. As a minimum, the scope of work for the site-based recovery teams should entail driving maintenance (be it on breakdowns and/or planned) quality control and engineering assurance, ensuring correct spares are specified and procured, and ensuring outage scopes are correct. These site-based teams must also provide technical support to the buyers of equipment; ideally buyers must be engineers or technicians trained in procurement processes and governance. Priority power stations (which are large and complex) for these site-based teams should be the following:

- Kusile (50 year life; shutdown estimated to be by 2073)

- Medupi (50 year life; shutdown by 2071)

- Majuba (50 year life; shutdown by 2050)

- Kendal (50 year life; shutdown by 2043)

- Matimba (50 year life; shutdown by 2041)

- Lethabo (50 year life; shutdown by 2040)

- Tutuka (50 year life; shutdown by 2040)

- Duvha (50 year life; shutdown by 2034)

- Matla (50 year life; shutdown by 2033)

- Kriel (50 year life; shutdown by 2029)

- Arnot (50 year life; shutdown by 2029)

- Establish site-based partial load losses recovery teams (made up of Eskom specialists and Independent Specialist Engineering Companies), reporting directly to the Power Station Manager. The site-based teams must, similarly, be empowered to make decisions without having to write endless memorandums and motivations to head office managers and committees. The Power Station Manager must be the final decision maker during this recovery. As a minimum, the scope of work for the site-based recovery teams should cover implementing interventions to reduce partial load losses, process engineering and trouble-shooting, conducting in-depth investigations and analysis of unit trips, proactive identification and technical management of single point of failures, handling security technical matters and providing primary energy oversight (coal quality, diesel management and accounting, fuel oil management and accounting). Priority power stations for these teams would be the same as those mentioned for the maintenance recovery and oversight teams.

- Establish site-based recovery teams for environmental compliance and MES upgrades (made up of Eskom specialists, Independent Specialist Engineering Companies and OEMs), reporting directly to the Power Station Manager. The site-based teams must be empowered to make decisions without having to write endless memorandums and motivations to head office managers and committees. The Power Station Manager must be the final decision maker during this recovery. Some of the technologies to be considered were highlighted in the opinion piece published by Mail & Guardian recently (Practical Steps to stop loadshedding by ZT Mathe). These include retrofitting emissions abatement technologies for sulphur removal, NOx reduction, and particulates removal. Deployment (through Public Private Partnerships) of Clean Coal Technologies, viz: use of Green Ammonia (produced from Green Hydrogen and Nitrogen) for removal of sulphur from coal combustion flue gas, producing ammonium sulfate fertiliser as a saleable by-product. Profits from selling ammonium sulfate could then be used to fund the retrofits of Low NOx Burners and the proven high frequency power transformers for the removal of particulates. The existing Electrostatic Precipitators and Dust Handling Plants must be upgraded accordingly.

- Mass recruitment of technical skills (including learners, artisans, technicians, engineers, and highly-experienced specialists). This recruitment process must be site driven, with the final decision maker (on the numbers and mix of required skills) being the Power Station Manager. Head hunting and external recruitment to be part of the recruitment strategies employed at site, without needing approval from head office.

- Use of local universities and universities of technology to conduct investigations. Outcomes and recommendations from these investigations must be practical and implementable. This must be done under the guidance of Eskom Research, Testing and Development (RT&D). In fact, RT&D needs to function as a world-class research organization that earns its living from implementable solutions that make a difference in the performance of Eskom’s plants and infrastructure (almost similar to earning revenue from licensing solutions and patent royalties). Massive technical training must be rolled-out per power station and accredit system engineers, technicians, plant managers, artisans, operators, etc.

- Reinstate incentive scheme for staff, irrespective of the financial position of the organisation. Without a motivated workforce, no plan will work. This intervention is crucial to get buy-in from Eskom guardians, especially organised labour. Of course having a proper performance management system, that is aligned with the strategic direction of the organization and key performance indicators, goes without saying!

- Daily updates be provided, through the Eskom Spokesperson, regarding progress to stop loadshedding. Daily updates to be structured as follows:

- Immediate steps (which is basically covered in this opinion piece)

- Short-term interventions

- Medium-term interventions

- Long-term interventions

Concluding Remarks

This opinion piece has clearly demonstrated that one of the main contributing factors to the root causes of sudden increase in loadshedding is not sustaining maintenance for the old fleet, particularly around 2018/2019/2020. There was an attempt to increase PCLF in 2021, and again this was not sustained in 2022. It is therefore not surprising that the breakdowns seem to have breached the roof in 2022. It is pleasing to see that Eskom increased maintenance during December 2022, notably PCLF reaching the highest ever in Week 52 at 16%. These high levels of PCLF must be maintained at this level and more for at least the next 6 months or so. Other measures and interventions as articulated in this opinion piece must be implemented immediately to ensure sustained improvement in technical plant performance, most likely to be realised toward the end of 2023. Unfortunately, the situation will get worse before getting better. It is important to protect the grid stability during the next 6 months. If the issue of grid stability is not taken seriously, then perhaps it is time to start planning for the worse-case scenario––a complete blackout!

By Dr Zwanani Titus Mathe, PrEng (ECSA 20030060), is Chief Executive of SANEDI

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation