Energy expert makes case for solar-wind-storage only IRP with game changing ‘superpower’

Integrated Resource Plan comprising only solar, wind and storage

Photo by Clyde Mallinson

Clyde Mallinson

An Integrated Resource Plan (IRP) comprising only solar, wind and storage (SWS) would deliver not only a load-shedding-free electricity supply industry but also create the platform for new industries to be built on near-zero-marginal-cost excess green electricity, a South African energy expert shows.

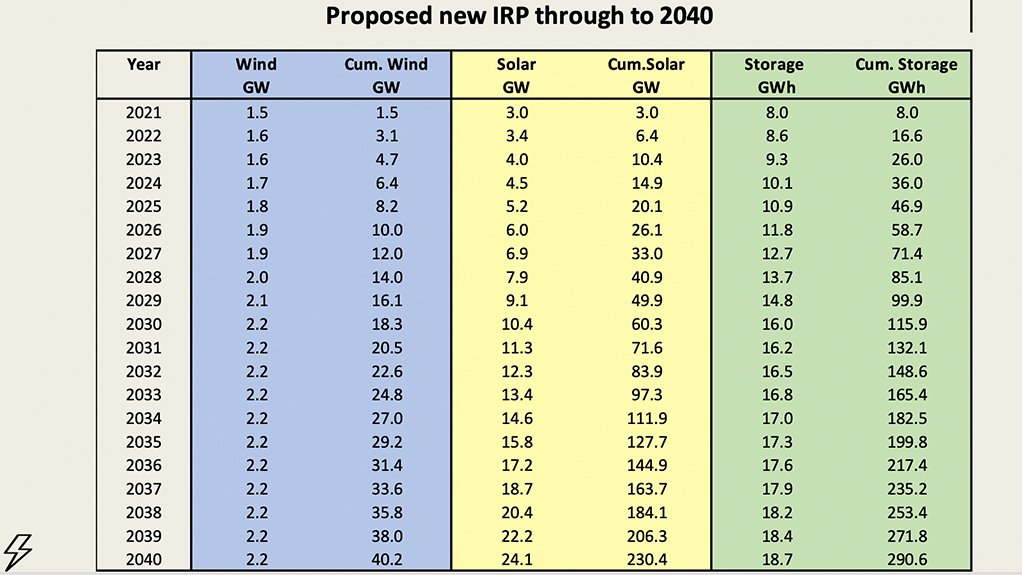

Detailed modelling undertaken by Clyde Mallinson outlines that this alternative SWS IRP would involve the deployment, between 2021 and 2040, of 40 GW of new wind, 230 GW of solar photovoltaic (PV) and 35 GW/290 GWh of storage, comprising mainly of battery energy storage and mechanical gravitational potential energy storage.

Such a system would cost $90-billion to build over the period at a yearly investment rate of about $5-billion, or about 1.5% of South Africa’s current gross domestic product.

It would deliver electricity at the factory gate at a cost of $0.03/kWh (R0.45/kWh in rand at prevailing exchange rates), well below Eskom’s current wholesale tariff of about $0.07/kWh, which are poised to rise to $0.15/kWh by 2030.

The SWS IRP deviates materially from the current IRP2019, which envisages a mix that is also dominated by wind and solar PV, but still includes new coal, gas and imported hydro.

Mallinson’s alternative IRP allocates far more to solar PV and storage than is the case in the IRP2019, with the wind and the storage designed to “see us through the night” and the capacity of the storage calibrated to the country’s current peak demand of about 35 GW.

The actual ratios of wind to solar PV could vary depending on future cost reductions, with the SWS IRP assuming a steeper decline in solar PV costs relative to wind over the period, reflected in the preponderance of solar PV in the IRP.

Such a system would not only adequately supply at least 231 TWh of conventional demand yearly but would also deliver a further 461 TWh of “superpower”, a term coined by independent US think tank RethinkX, or near-zero-marginal-cost clean electricity.

This ‘superpower’, Mallinson argues, could be used to bolster the competitiveness of existing economic activities such as mining and smelting, while opening prospects for new activities such as electric mobility, the low-cost desalination of water, or the production of green hydrogen for use in hard-to-abate sectors.

The large-scale output of the SWS fleet would be three times that of the current coal-dominated system, based on Mallinson’s reinterpretation for South Africa of the ‘Clean Energy U-Curve’ used by RethinkX to model a 100% clean-energy system for America.

That U-curve shows that the lowest-cost system, or “sweet spot” for South Africa would involve building an SWS fleet that produces 1.67 times the annual output of South Africa’s current fleet, at a cumulative capital cost of $71-billion. Such a system would deliver 155 TWh of so-called superpower, while meeting yearly conventional demand of 231 TWh.

However, Mallinson’s IRP is premised on a system that by 2040 will produce three times that of the current system, as it would deliver 461 TWh/y of near-zero-marginal-cost surplus green electricity for an investment only $25-billion larger than the least-cost solution.

“For only 38% more investment above the least-cost sweet spot, you get a disproportionate amount of superpower,” he explains, describing it as the 2040 target for which South Africa should be aiming.

MARSHALL PLAN-TYPE EFFORT

Mallinson argues that the disruptive changes under way in the electricity supply industry –facilitated by the precipitous decline in wind, solar PV and, more recently, storage costs – are irreversible and that instead of continuing to debate the mix of technologies, South Africa should turn its attention to accelerating SWS investments.

“South Africa’s combination of wind and solar is among the best in the world,” Mallinson asserts, adding that leveraging these resources through a system that offers both security of supply and superpower could unleash massive growth and job creation.

“We really need to be building wind and solar resources as if our lives and livelihoods depended on it.”

“The time for talking is over, we need a Marshall Plan-type push to overcome the logistics and construction capacity constraints to implementation, because we can only retire the coal fleet once we have created new generation headroom – you can’t scrap your old car before you buy your new one if you are a travelling salesperson,” Mallinson quips.

To fully exploit the superpower that will arise, however, will require a shift from a demand-driven electricity system to one where the generation profile becomes the “kingmaker”.

“The generation profile will dictate what the demand profile morphs into, with new demand adapting itself to those periods when the near-zero-marginal-cost excess green electricity is available.

“Clearly, then, if you have an electric vehicle in future, you will probably be charging it in the middle of the day because there is going to be a surplus available at lowest cost, whereas currently if you are charging your vehicle from the grid you would probably be encouraged to charge at night.”

Likewise, the other sectors that will be electrified will adapt themselves to the generation profile of the future.

“This is what is so exciting: there are going to literally be hundreds of new business cases that become available when we have low marginal cost electricity throughout the day,” Mallinson explains, likening it to the Internet, which has rapidly transitioned from consumers paying for a few minutes of dial-up to uncapped Internet at a fixed monthly charge.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation