Cell C's Mendes optimistic over latest results

Cell C CEO Jorge Mendes and acting CFO El Kope discuss Cell C’s audited financial results for the 2021 and 2022 financial year.

Cell C acting CFO El Kope

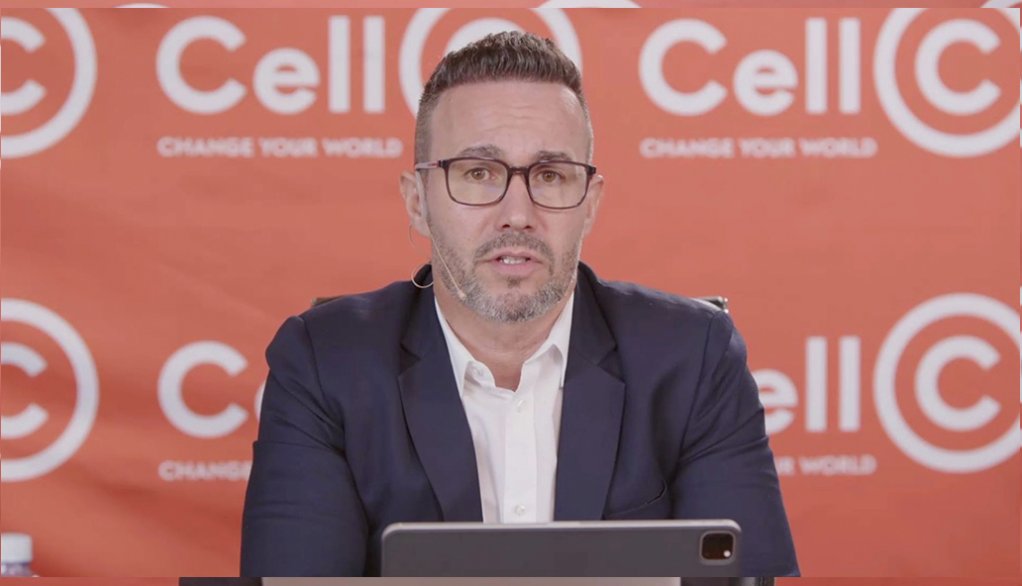

Cell C CEO Jorge Mendes

Telecommunications group Cell C on Monday reported a loss before interest, taxes, depreciation and amortisation of R907-million for the year ended December 31, 2022.

This is a 509% decline compared with earnings before interest, taxes, depreciation and amortisation (Ebitda) of R222-million for the 2021 financial year, owing to revenue reduction, the continued evolution of direct expenditure in line with the network transition plan and lower operating costs.

The more recent Ebitda for the six months ended June and nine months ended September 2023 have not yet been provided.

However, Cell C CEO Jorge Mendes said that the company's business stabilisation efforts are yielding improved results, positioning the company for a return to growth and enhancing competitiveness in the market after a “rebasing year”.

According to the latest data provided by Cell C, on a normalised basis, excluding the R1.12-billion recapitalisation, liquidity and transition costs incorporated into earnings before interest and taxes, Ebitda for the period under review was R214-million, compared with the normalised Ebitda of R1.05-billion in the prior year.

The company swung from a loss before taxes of R92-million in 2021 to net income before taxes of R5.22-billion in 2022, mostly owing to the recapitalisation and the continuation of the network transition.

Operating expenditure reduced 14% to R3.4-billion in the 2022 financial year, from R3.96-billion in 2021, owing to the ongoing network transition, while direct expenditure increased 1% to R9.4-billion.

The network transition, implemented in line with Cell C’s capital expenditure-light operating model, resulted in an increase in roaming costs, which has a direct impact on the gross margin.

Despite the increase in direct costs, the gross margin percentage improved from 29% in 2021 to 30% in 2022 owing to a change in product mix, said Cell C acting CFO El Kope.

During the year-to-date to September 30, 2023, Cell C’s direct expenditure increased to R8.09-billion from R7.55-billion in the comparative period in 2022, as the company finalised its network transition in June.

During this period, the company’s gross margin declined to R1.99-billion, from R2.59-billion in the nine months to September 2022.

Revenue declined 9% from R12.99-billion in 2021 to R11.83-billion for the 2022 financial year.

During the year to date to September 2023, overall revenue was marginally down at R10.09-billion, from the R10.14-billion reported in the comparative period in 2022, demonstrating resilience in a challenging environment exacerbated by loadshedding.

The average blended revenue per user (ARPU) increased from R74 in 2022 to R80 by the end of September 2023 owing to an increase in high-quality subscribers.

“Cell C has now aligned to the industry norm of reporting on consumer ARPU which is a combination of prepaid and postpaid service revenue. Previous reporting had been at net revenue and inclusive of other revenues outside of consumer,” Mendes explained.

Meanwhile, the focus to prioritise key performance indicators started to yield results, with the third quarter of the 2023 financial year reflecting a growth trajectory in revenue and continued cost management.

“This entailed driving the return to growth and profitability, leveraging the improved network quality and creating awareness with customers on the better connectivity, as well as launching propositions to induce trial. This was further buoyed with embedding a culture of execution excellence, building staff and stakeholder confidence.”

During the third quarter of 2023, Cell C’s revenue increased 1.5% driven by improved execution for prepaid and continued growth in wholesale, postpaid and equipment sales.

This quarter has been the first quarter in 2023 where Cell C is showing revenue growth versus prior year.

“With our newly formed management team, building a great culture, a fully operational network and a robust strategy, Cell C is well-positioned to drive growth and profitability. We have implemented several strategic initiatives to drive revenue generation and reverse the struggling performance we experienced in the past,” Mendes commented.

“I am pleased that in the last quarter of 2023, we are seeing improved performance momentum. By leveraging our robust network infrastructure, we aim to capitalise on growth opportunities in the market and deliver sustainable performance in coming years,” he concluded.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation