Name of the Project

Scarborough gasfield development.

Location

In the Carnarvon basin, about 375 km west-north-west of the Burrup Peninsula, in Western Australia.

Project Owner/s

The project is a joint venture (JV) between Woodside Petroleum and BHP. The JV partners reached an agreement in February this year to align their participating interests across the Scarborough and North Scarborough titles, resulting in Woodside’s holding a 73.5% interest and BHP holding the remaining 26.5% interest in both titles.

Project Description

Woodside is proposing to develop the Scarborough gas resource, which has a contingent resource of 11.1-trillion cubic feet and supports the recovery of more than 500-billion cubic feet per well.

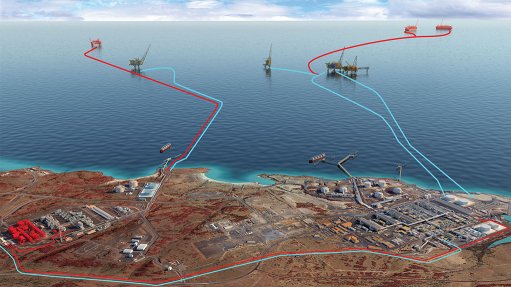

The new offshore facilities will initially have seven high-rate, subsea gas wells tied back to a semisubmersible floating production unit moored in 900 m of water close to the Scarborough field.

Woodside’s preferred concept is to process Scarborough gas through a brownfield expansion of the existing Pluto liquefied natural gas (LNG) onshore facility.

Potential Job Creation

Not stated.

Capital Expenditure

Woodside recently flagged a 5% increase in the capital cost estimate for the Scarborough development, which is now estimated to require a $12-billion capital investment comprising a $5.7-billion investment for the offshore component and a $6.3-billion investment for the onshore component.

Planned Start/End Date

First production from the Scarborough gasfield has been targeted for 2026.

Latest Developments

Engineering work is progressing at Scarborough.

BHP and Woodside have developed a plan towards a Scarborough final investment decision by the end of the 2021 before the proposed completion date for the merger.

As part of this plan, BHP and Woodside have agreed on an option for BHP to divest its 26.5% interest in the Scarborough JV to Woodside and a 50% interest in the Thebe and Jupiter JVs to Woodside, if the Scarborough JV makes a final investment decision by December 15, 2021, and the merger does not proceed.

Key Contracts, Suppliers and Consultants

SNC Lavalin (engineering subdesign contract).

Contact Details for Project Information

Woodside, tel +61 8 9348 4000.