BRPM achieved a steady operational performance, which was hoever offset by a weaker operational performance from Styldrift

Platinum group metals (PGMs) miner Royal Bafokeng Platinum (RBPlat) has recorded a 29% year-on-year decrease in revenue to R5.81-billion for the six months ended June 30.

Earnings before interest, taxes, depreciation and amortisation (Ebitda) also decreased, by 85.1% year-on-year, to R507.4-million, resulting in its Ebitda margin decreasing to 8.7% from 41.7% in the comparative period.

RBPlat swung to a headline loss of R330.3-million, compared with headline earnings of R2.22-billion in the first half of the prior year.

“The operating environment for the first half of this year was characterised by a decline in the basket price, combined with ongoing inflationary pressure on the operating costs of the business.

“RBPlat’s steady operational performance was offset by a weaker operational performance from Styldrift, which was caused by a slower recovery from the operational challenges experienced last year,” says RBPlat CEO Steve Phiri.

During the first six months of this year, the rand weakened against major currencies, while PGM prices declined.

The group’s consolidated gross loss amounted to R394.9-million, compared with a gross profit of R2.79-billion in the first half of 2022.

OPERATIONAL REVIEW

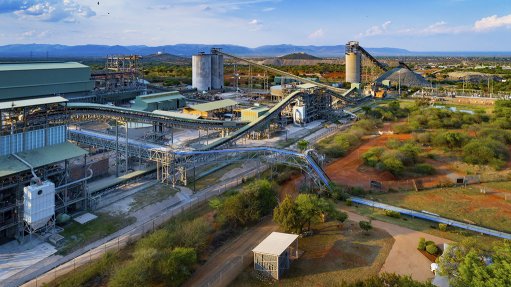

The Bafokeng Rasimone Platinum Mine (BRPM) achieved a steady operational performance. This was, however, offset by a weaker operational performance from Styldrift owing to a slower recovery from operational challenges experienced last year.

Total tonnes hoisted decreased by 1.5% to 2.3-million tonnes, with BRPM’s tonnes hoisted marginally reducing by 0.1% to 1.28-million tonnes. Styldrift’s tonnes hoisted declined by 3.1% to 1.02-million tonnes, owing to ongoing operational challenges in addressing resource inefficiencies and ore generation constraints.

Total tonnes milled during the reporting period increased by 2.4% to 2.36-million tonnes, with Merensky reef contributing 1.58-million tonnes and the Upper Group Two (UG2) reef 782 000 t.

BRPM’s tonnes milled increased by 2.4% to 1.3-million tonnes, with UG2 accounting for 60.4% of total BRPM milled production. Styldrift’s tonnes milled increased by 2.5% to 1.07-million tonnes.

“The total four-element (4E) built-up head grade decreased by 2.9% from 3.75 g/t in the first half of last year to 3.64 g/t. This is mainly attributable to an increase in on-reef mining dilution at Styldrift, increased tonnage contribution from the lower grade South mining section of Styldrift, and a higher contribution of lower grade BRPM South shaft UG2 tonnage to the overall ore mix.”

Despite the higher milled volumes, the combined lower built-up head grade and reduction in concentrator recoveries resulted in a 1.8% and 2.5% decline in six-element and 4E metals in concentrate, to 2.49-million ounces and 2.2-million ounces, respectively.

RBPlat adds that year-on-year cash operating costs increased by 16.5%, or R715-million to R5.04-billion. This is attributable to higher working cost development, increased concentrating costs, higher trackless fleet maintenance costs, and persistent inflationary pressures associated with the industry.

OUTLOOK AND GUIDANCE

RBPlat emphasises that the outlook for platinum is more positive compared to palladium and rhodium.

“Platinum is expected to be in a deficit in 2023, supported by a recovery in vehicle sales, partial substitution of palladium with platinum in light-duty vehicles and an increase in industrial demand.

“Despite the increase in electrification of vehicles and substitution, palladium is forecast to be in a small deficit this year. Rhodium is also expected to be in a slight deficit,” the company points out.

Subject to any unforeseen operational disruptions and challenges regarding costs, RBPlat’s full-year production guidance remains at between 4.65-million and 4.90-million tonnes at a grade of 3.78 g/t to 3.80 g/t 4E, which will yield 470 000 oz to 490 000 oz of 4E metals in concentrate.

Group cash unit costs are forecast to be between R19 750/oz and R20 500/oz.

Fellow South African PGMs miner Impala Platinum is close to buying out all minority shareholders in RBPlat and intends to delist the company from the JSE.