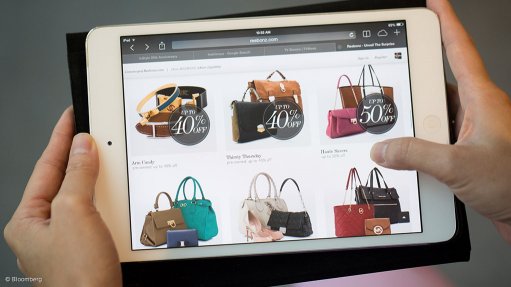

Photo by: Bloomberg

Online retail revenue in South Africa grew by about 66% to R30.2-billion in 2020, accounting for about 2.8% of total retail revenue.

Last year’s growth in online retail revenue was significantly higher than the 25% growth from R11.3-billion in 2017 to R14.1-billion in 2018.

Online retail revenue is also estimated to grow by 40% this year to R42-billion and 30% in 2022 to R50-billion and is expected to stabilise at about 4% of the value of total retail revenue in South Africa, the ‘Online Retail in South Africa 2021’ study shows.

The study was conducted by market research firm World Wide Worx with the support of payments multinational Mastercard, financial services firm Standard Bank and digital transformation services company Platinum Seed.

Online retail as a proportion of total national retail was only 1.4% in 2018 and, prior to the pandemic and the shift in purchasing habits had been predicted to only reach 2% by 2022, World Wide Worx MD Arthur Goldstuck said at the report’s release on May 12.

Preliminary data from Statistics South Africa shows total retail decreased by 4.2% to R1.05-trillion in 2020. The percentage of retail made up by online retail sales came to 2.8%, double the percentage for 2018.

“We can expect to see total online retail sales of around R42-billion in 2021, taking the online percentage of total retail to around 4%, assuming traditional retail returns to its previous growth path,” he said.

Retail is expected to continue growing to about R1.1-trillion this year and R1.2-trillion in 2022, and online retail will increase its proportion of total retail revenue. Online retail could possibly overtake 5% of total retail by 2022 and represents a shift in online retail in South Africa, the study indicates.

Average penetration of online retail in South Africa was low prior to the pandemic with about 3.5% of consumers routinely shopping online, and this was skewed along age, education and income lines, with younger people and those with higher education and income more likely to shop online routinely.

However, there has been a significant shift in adoption, with a normalisation across all age groups and adoption averaging 27%, only dropping to 19% adoption among people aged 65 or above.

“Total retail during the initial period of hard lockdown in South Africa plummeted by almost half during the second quarter of 2020, and into that gap came the online retail revolution. Every online retailer found ways to get to customers' front doors more quickly as [customers] could not get to the retailers' doors,” said Goldstuck.

“In 2018, only about 3.5% of people regularly shopped online and, currently, about 6% regularly buy groceries and about 5% regularly buy clothing online. This represents a significant shift in people's shopping habits.”

The massive shift in online shopping habits represents an opportunity for online and physical retailers. Retailers that have a physical presence but not an online one will have to embrace online retail, not to survive, but because their customers will increasingly expect to find them online, he noted.

Initially during the lockdown, consumers bought necessities online, such as food, clothing and data, but the categories of online purchases migrated to include virtual services and entertainment, added Mastercard South Africa country manager Suzanne Morel.

“This presented retailers with a significant challenge, although many were able to pivot to tap into their market share and test how nimble they were. In many ways, retailers were not restricted to a physical footprint. The study found that 71% of respondents said they would continue shopping online post-pandemic,” she said.

Meanwhile, Standard Bank's online purchase data increased to 24% of all purchases in 2020 from 17% in 2019. This has peaked at about 29% and has since moderated to about 23% to 25%, Standard Bank head of digital and e-commerce Andrew van der Hoven pointed out.

Consumers are engaging more on digital platforms and online and Standard Bank expects to see a proliferation of payment methods and for consumers to gravitate to managed marketplaces that aggregate brands and offerings.

“The growth in online purchases represents almost 17 years of growth in a single year,” he said.

Goldstuck noted that one possible drawback is that not everyone has the Internet connectivity at home to do online shopping.

Further, it is important to ensure that people have the opportunity to participate.

Different payment methods and the fierce level of competition in this space would help to ensure that people can conduct online purchases, said Morel.

“From a merchant perspective, large retailers were able to pivot quickly and some had established online presences. MasterCard partnered with Standard Bank and [Internet services giant] Google and others to ensure that small and medium-sized enterprises (SMEs) could participate and survive.

“SMEs, even those who operated mainly using cash, are beginning to adopt online practices, such as quantity recognition codes and alternative payment methods,” she said.