Photo by: Sovereign Metals

Name of the Project

Kasiya rutile/graphite project.

Location

Central Malawi.

Project Owner/s

Sovereign Metals and Rio Tinto.

Rio Tinto invested in Sovereign in July 2023, resulting in an initial 15% shareholding and options, and expiring within 12 months of initial investment, to increase its position to 19.99%. Under the investment agreement, Rio Tinto will provide assistance and advice on technical and marketing aspects of Kasiya, including on Sovereign’s graphite co-product, with a primary focus on spherical purified graphite for the lithium-ion battery anode market.

Project Description

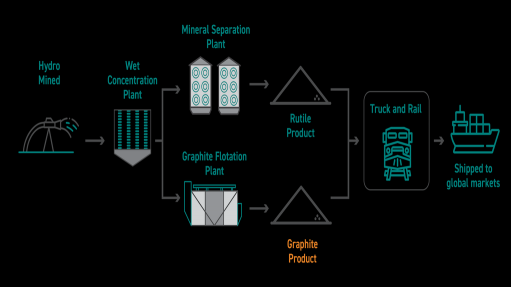

Kasiya is the biggest natural rutile deposit and second-largest flake graphite deposit in the world.

A prefeasibility study has confirmed a potentially major critical minerals project, with an extremely low carbon dioxide footprint delivering significant volumes of natural rutile and graphite while generating significant economic returns.

The proposed large-scale operation will process 24-million tonnes of ore a year to produce an estimated 245 000 t of natural rutile and 288 000 t of natural graphite a year at steady state, for an initial mine life of 25 years.

The project is positioned to become the world’s biggest rutile producer at 222 000 t/y and one of the world’s biggest natural graphite producers outside of China at 244 000 t/y, for an estimated life-of-mine of 25 years.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $1.61-billion and an internal rate of return of 28%, with a payback of 4.3 years from the start of production.

Capital Expenditure

Capital costs to first production are estimated at $597-million. Expansion capital is estimated at $287-million.

Planed Start/End Date

Not stated.

Latest Developments

Sovereign Metals has announced that a bulk sampling programme – to extract more than 100 t of ore from the Kasiya project to produce more than 1 000 kg of natural graphite for lithium-ion battery anode testwork and product qualification – is under way.

The programme is part of the company’s graphite bulk sample programme for qualification, downstream testwork and product development.

A major component of graphite sales agreements is customer qualification, with graphite produced from this programme to be shared with prospective end-users, in addition to being used for upscaled downstream testwork.

Previous testwork confirmed Kasiya’s graphite would have near-perfect crystallinity and a high purity – both key attributes for suitability in lithium-ion battery feedstock.

The upscaled graphite qualification programme will support upcoming project studies with Rio Tinto.

Sovereign and Rio Tinto have agreed to collaborate to qualify graphite from Kasiya, with a particular focus on supplying the spherical purified graphite segment of the lithium-ion battery anode market.

Sovereign has noted that this upscaled graphite programme comes as China is curbing exports of natural graphite under “national security” concerns.

China produces 61% of all flake graphite used in the production of lithium-ion battery anodes and accounts for 93% of all graphite anode production globally.

Key Contracts, Suppliers, and Consultants

None stated.

Contact Details for Project Information

Sovereign Metals, Tel +61 8 9322 6322, or email info@sovereignmetals.com.au.