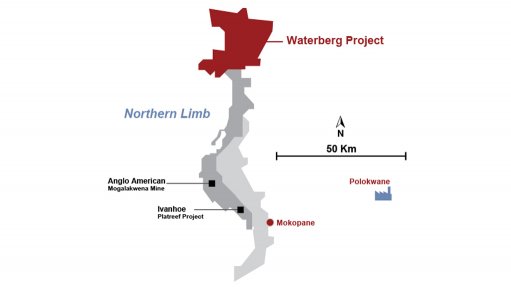

Map of the Northern Limb of the Bushveld Coplex.

JOHANNESBURG (miningweekly.com) – Platinum group metals (PGMs) mining and marketing company Implats, which on Wednesday reiterated its support for the Waterberg development project and its joint venture (JV) partners, also expressed its intention to remain an active participant in the project at its current 15% shareholding level.

This participation, the JSE-listed Implats said, would include funding its share of costs, depending on future implementation decisions taken by all the JV partners.

In addition, Implats confirmed that its offtake rights to concentrate from the project remained unchanged and affirmed its commitment to continue negotiations in this regard with the JV partners in good faith.

Moreover, it would continue to fund to a maximum of the previously-announced R55-million costs associated with further study and optimisation work to derisk the project implementation programme, with planned studies expected to be complete by mid-August.

Toronto-listed Platinum Group Metals holds a 50.2% interest in Waterberg JV directly and indirectly and is the manager of the project. Other shareholders of Waterberg JV include Japan Oil, Gas and Metals National Corporation, Hanwa and Mnombo Wethu Consultants.

The Waterberg project is a bulk underground palladium, platinum, gold and rhodium project. An independent definitive feasibility study (DFS) for it was approved in December.

Under the JV agreements, Implats had until 90 days after the still-to-be-granted mining right to exercise its purchase and earn option into a 50.01% interest in the project.

But Implats stated in a media release to Mining Weekly that its board had resolved not to exercise its control option at this time after taking into account these four main considerations:

- the long-term PGMs demand outlook combined with the project schedule and production ramp-up profile;

- Implats’ funding and return requirements at 50.01% shareholding in the context of the group’s capital allocation framework, which prioritises balance sheet strength and shareholder returns;

- the more-recent implications of the Covid-19 pandemic on the global economic outlook; and

- investor financing appetite for large greenfield projects in general.

Implats’ strategic investment in the Waterberg project and its right to acquire majority ownership in it through the exercise of a sale and subscription option following completion of a DFS, began in 2017, ahead of its acquisition of North American Palladium in Canada last year, which has since been renamed Impala Canada. The North American transaction added the Lac des Iles mine, in Ontario, to Implats’ South African portfolio.