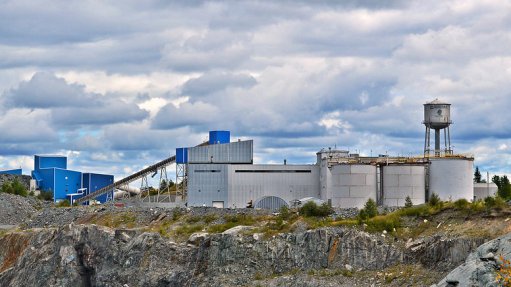

The QMX acquisition broadens Eldorado's organic opportunities near Lamaque (pictured).

TSX-listed Eldorado Gold and TSX-V-listed QMX Gold have entered into a definitive agreement pursuant to which Eldorado will acquire all of the outstanding shares of QMX, not already owned by Eldorado, for about C$132-million on a 100% and fully diluted basis.

Eldorado currently owns 68.1-million shares, or 17%, of QMX.

Following completion of the arrangement, QMX shareholders will own about 2.8% of the issued and outstanding shares of Eldorado.

The agreement significantly increases Eldorado’s footprint and landholdings in the Abitibi Greenstone Belt, in Canada, by about 550%, which is consistent with its strategy to invest in world-class mining jurisdictions where it currently operates.

The agreement also adds a pipeline of additional organic opportunities proximal to Lamaque, which can be exploited by leveraging existing infrastructure and Eldorado’s strong operational, exploration and stakeholder expertise.

Additionally, Eldorado’s overall risk profile is enhanced through the addition of future growth prospects in one of the top mining jurisdictions in the world.

“This transaction expands our position in the Abitibi camp and is consistent with our strategy of pursuing growth at Lamaque in Quebec, a high-quality jurisdiction,” Eldorado president and CEO George Burns comments.

He notes that “QMX’s highly prospective land package is ideally located immediately adjacent to [the company’s] current Lamaque operation and associated exploration projects in the heart of the Val d’Or gold district”.