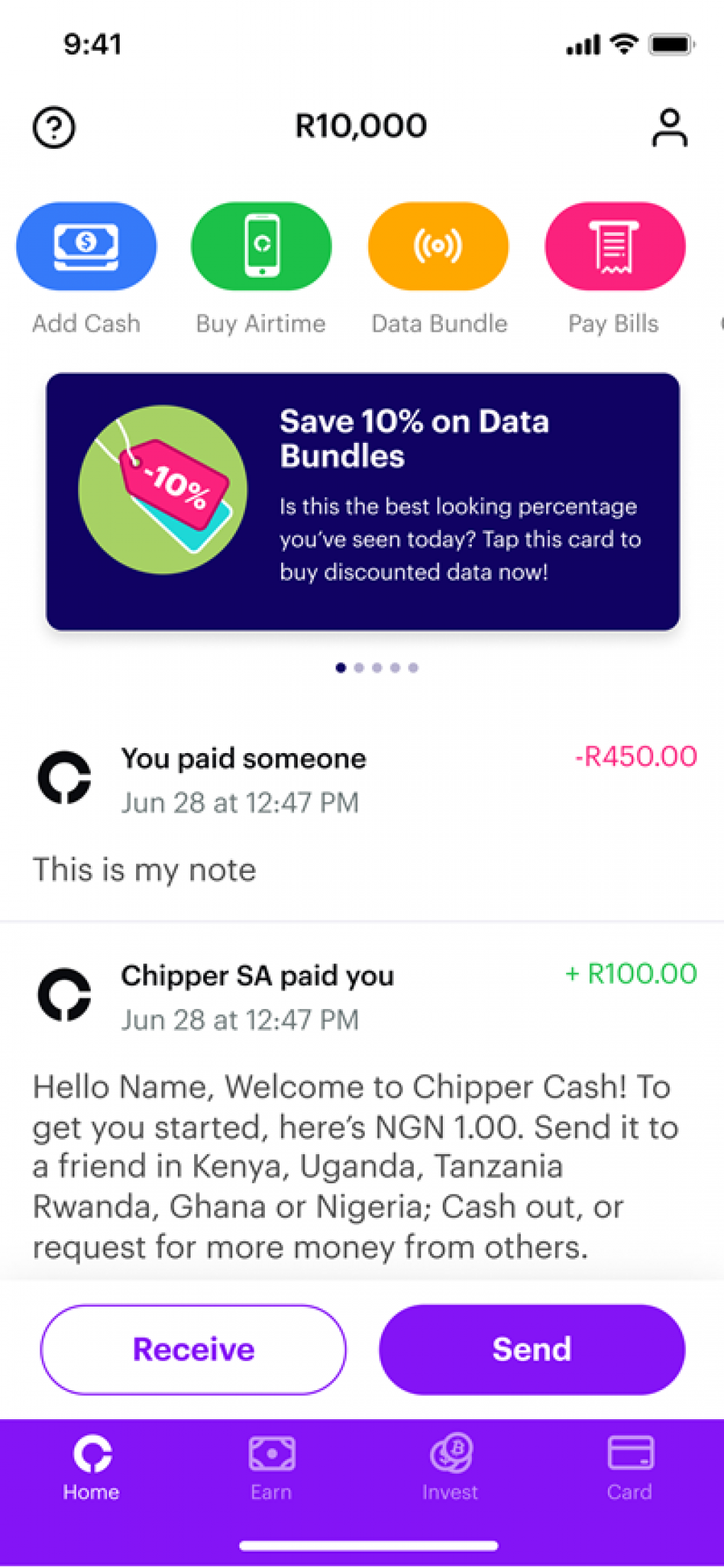

EASY TRANSFERS Chipper’s mobile application enables free, unlimited and instant domestic money transfers

Startup fintech Chipper Cash has launched its services in South Africa, offering free domestic peer-to-peer (P2P) money transfers as the company rapidly expands its network across Africa.

Chipper’s mobile application enables free, unlimited and instant domestic money transfers, selected investments in cryptocurrencies and the buying and sending of airtime and data to others.

San Francisco-headquartered Chipper, founded in 2018 by CEO Ham Serunjogi and president Maijid Moujaled, aims to “chip away” at the challenges of inaccessible financial services, a high number of underbanked consumers, a reliance on cash for daily commerce and the difficulty of cross-border transactions.

The Chipper Cash mobile application was created to make money transfers easy and efficient for Africans at scale, to increase access to financial services for the underbanked and to digitalise daily payments to ease reliance on cash.

The South African launch brings the company’s African network to a total of seven African countries, including Ghana, Kenya, Rwanda, Tanzania, Uganda and Nigeria.

The mobile app’s money transfer services are easy, secure and fast, and allows people to safely and freely move money domestically and across the continent.

“Domestic remittances are a lifeline for many families in South Africa. Over R157-billion moves between provinces every year, with people sending money to their families and friends,” says Chipper Africa strategy and partnerships VP Pardon Mujakachi.

“This is not only the result of the 7.7-million people who moved to other provinces for work, but it is the overall 24-million South Africans who send money to each other daily.”

Mujakachi adds that the easy-to-use application will enable South Africans to instantly send money anywhere in the country from their mobile phones, with additional features, such as cross-border transfers across countries within the network, to be introduced in due course.

“We believe that Chipper Cash will help formalise local and regional remittances that tend to be sent through informal channels, which can be expensive, unsafe and unreliable.”

In addition, Chipper Cash allows people to buy, sell and transfer Bitcoin, Ethereum and USD Coin within the application.

The group, founded by Africans and built out by a global team, with multiple offices across the globe, including the UK, raised $100-million in a Series C funding round in June.

It has over four-million users globally, with up to 80 000 transactions processed a day.

“Chipper Cash’s speed, very low cost and user-friendliness challenges the high fees, complicated processes and slow transfer times of traditional money transfer. Its interface is intuitive, simple and makes sending money to friends and family as simple and instant as sending a text,” Mujakachi says.

The mobile application, which can be downloaded on iOS and Android, requires new users to register a profile to get into the Chipper Cash ecosystem.

The app’s services, however, are not accessible unless users are verified through a know-your-customer process, where users submit a form of identification, such as an ID or a valid passport.

After verification is complete, users can then connect their existing online bank account to their Chipper Cash profile.