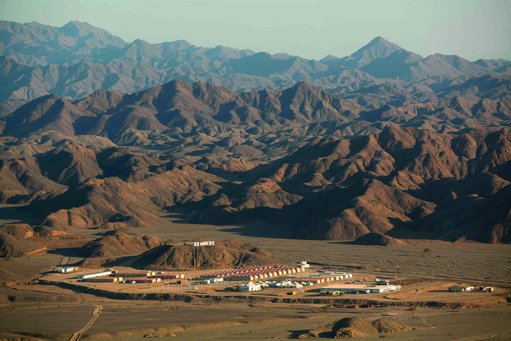

The Sukari gold mine

Established gold miner Centamin achieved a 25% year-on-year increase in adjusted earnings before interest, taxes, depreciation and amortisation to $398-million for the year ended December 31, 2023, at a 45% margin, compared with 40% in 2022.

Gold production of 450 058 oz, was 2% higher year-on-year and in line with guidance.

All-in sustaining costs (AISC) improved by 14% year-on-year to $1 205/oz, beating 2023 guidance.

“Despite ongoing local inflationary pressures, we reduced our AISC by $194/oz versus 2022, beating the lower end of our guidance range,” CEO Martin Horgan says.

Yearly capital expenditure (capex) of $204-million was below guidance of $272-million, owing to cost savings, lower capitalisation of costs and changes to equipment rebuild schedules.

The Sukari gold mine, in Egypt, made a cash contribution of $121-million, including $45-million in cost recovery and $112-million of profit share, net of $36-million capex funded from corporate.

Government profit share and royalties totalled $139-million.

Group free cash flow was $49-million, up from -$18-million in 2022.

Centamin says it has a robust balance sheet with cash and liquid assets of $153-million, as at period end, and total liquidity of $303-million, including the undrawn $150-million sustainability-linked revolving credit facility.

It declared a final dividend of $0.02 apiece, equating to $23-million, subject to approval at the annual general meeting on May 21.

The total dividend for full-year 2023 is $0.04 apiece or $46-million.

“With the reinvestment programme ending in 2024, Sukari has been repositioned towards consistently delivering 500 000 oz/y over the long term, with further growth and cost saving opportunities identified,” Horgan outlines.

“Looking ahead to 2024, the grid connection project will continue our recent success in taking costs out of the business while delivering into our near-term decarbonisation targets of reducing our Scope 1 and 2 emissions by 30% by 2030.

“We will continue to advance the organic growth opportunities within our portfolio of assets by aggressively following up on the recent exploration success with our Eastern Desert Exploration drilling programme (EDX) and proceed towards an investment decision at Doropo in Côte d’Ivoire following the publication of the definitive feasibility study later this year,” Horgan explains.

Scope 1 and 2 greenhouse-gas emissions have been reduced by 7% since the 2021 base year, driven primarily by the 21.5-million litre reduction in diesel consumption during the first full year of solar power generation.

Centamin is aiming to complete the DFS for the Doropo project in Côte d’Ivoire by mid-year.

The EDX exploration update is expected in the second half of the year.

The Sukari 50 MW grid connection project construction is also slated for this period, as is the completion of a solar expansion study.

Guidance for this year remains unchanged at 470 000 oz to 500 000 oz, cash costs of $700/oz to 850/oz and AISC of $1 200/oz to $1 350/oz.

The adjusted capex guidance is $215-million, including $112-million of sustaining capex, and $103-million of non-sustaining capex, of which $58-million is allocated to growth projects that are funded from Centamin treasury under the Sukari Concession Agreement and costs recovered over three years.

Adjusted capex excludes $91-million of sustaining deferred stripping reclassified from operating costs.