American nuclear company Westinghouse Electric, part of Japan’s Toshiba group, is offering South Africa a broad range of options for the country’s future nuclear power plant (NPP) programme. Currently, Pretoria intends to generate 9.6 GW of electricity from nuclear power by 2030. “The construction programme might be with us, or separate from us,” says Westinghouse Electric international project development director Robert Pearce. “We are willing to offer everything from full turnkey to being the technology partner, doing the design, and letting others do the construction.”

“We’re certainly prepared to localise, do skills building and create an export industry to make the local [nuclear] industry sustainable,” he adds. “But we’ve not been officially told what the [localisation] intent is. We just have hints.”

The US company is offering its latest design, the AP1000. This is a Generation III+ pressurised-water reactor (PWR) with a design capacity of 1 154 MWe. This means that nine AP1000s would be needed to fulfil South Africa’s 9.6 GW target. “The first would have less localisation than the ninth,” he points out.

“A key factor regarding localisation is: How much are companies here [in South Africa] prepared to invest? A lot of components – pumps and valves – are already made here. Nonsafety stuff can easily be supplied in South Africa. But larger components are more complex and need more qualifications and so need lots of investment, running into the billions. If companies are willing, they could become part of the supply chain for the later NPPs, but they would need to win global orders, to be sustainable.”

Westinghouse states that a major aim in the design of the new reactor was simplification: a simplified plant design, including simplified instrumentation and control systems, control room, normal operating systems, overall safety systems and construction techniques. The simpler the system, the less there is that can go wrong. In comparison to previous Westinghouse PWR designs, the AP1000 has 50% fewer safety- related valves, 80% less safety-related piping, 35% fewer pumps, 85% less control cabling and 45% less seismic-resistant building volume.

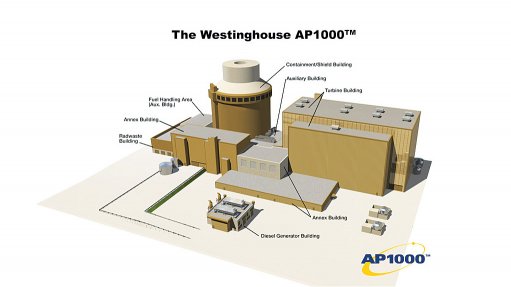

Construction is modular, and the NPP is so arranged as to separate the nuclear island (containing the reactor and its systems), the turbine building, the annex building (offices and support systems), the diesel generator building (emergency power supply) and the radwaste building (where the spent fuel and other, lower-level, radioactive waste is stored).

Each of these buildings is erected on its own base mat. The result is an NPP that is simpler and cheaper to build, operate and maintain.

The AP1000 is designed for a 60-year life span and to be refuelled every 18 months. Its safety is also much improved. “It is a passive safety design,” explains Pearce. Indeed, the prefix AP in the reactor designation stands for Advanced Passive. Consequently, in the event of a failure or accident, the reactor will shut itself down without any action by its operators. Moreover, the shutdown procedure does not require any pumps or any other system that needs power. Rather, shutdown depends on gravity, natural circulation and compressed gases. The reactor does have active shutdown systems, but these are not designated as safety systems; rather, they are used for scheduled shutdowns for maintenance and refuelling.

This means that the amount of safety-critical equipment in the NPP is minimised. As safety equipment requires the highest levels of certification and qualification to manufacture, this makes it easier for local companies to supply a greater proportion of the NPP equipment.

Westinghouse is also willing to be flexible on the issue of financing the new NPPs. “At one end of the spectrum, the programme could be financed partly through equity and partly through debt. The US Eximbank would be willing to participate,” reports Pearce. “At the other end, there might be a requirement for equity participation in the ownership of the plant itself, through the construction phase, by Westinghouse. We would be willing to consider it, under the right conditions – there has to be a proper prospect of getting a return on our investment. Westinghouse is not a utility. We do not look to operate NPPs.”