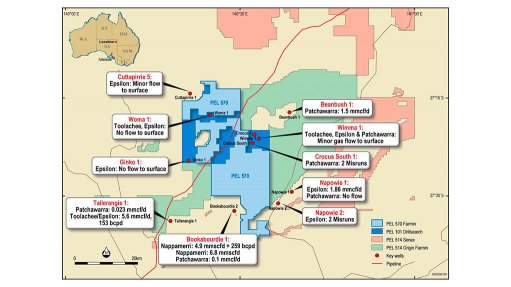

Cooper basin PEL 570

JOHANNESBURG (miningweekly.com) – ASX-listed energy explorer Sundance Energy announced on Monday that it had entered into an agreement to buy A$24-million worth of assets from oil and gas explorer New Standard Energy (NSE) in the US and South Australia.

The agreement was subject to approval by NSE’s shareholders and other customary conditions precedent including due diligence.

Sundance would directly acquire NSE’s Colorado county and its Atacosa oil and gas projects in the US, as well as an interest in the Cooper basin shale gas project, in South Australia, through the purchase of NSE’s relevant subsidiaries.

The 5 500 acre Atacosa project included seven producing wells, with net production of about 175 bbl/d of oil equivalent and two wells that have been drilled, but not completed.

The 2 400 km2 Cooper basin PEL 570 licence permit consisted of five parts; two in the core of the Patchawarra trough and three located north of the Patchawarra trough.

NSE said it would seek shareholder approval for the transaction at a meeting to be held in late July this year. The company’s board members have agreed to vote their shareholdings in favour of the transaction.

Agreement has also been reached with Switzerland-based multinational financial services company Credit Suisse to continue funding the company, to the extent required, through to the completion of the transaction.

NSE chairperson Arthur Dixon said the company’s growth plans and focus on the US had “clearly” been impacted by the speed and intensity of the collapse in global oil prices.

“The board recognised the significance of the changed commercial environment and late in 2014 initiated an extensive and intense process to seek and evaluate corporate transactions, joint ventures and asset sales or swaps for all NSE assets,” he stated.

Dixon added that concurrently, NSE “slashed” its corporate costs and sought out corporate and asset opportunities. This he said would enable the company to completely “unwind” its debt position and future liabilities, while providing some capital to sustain NSE and retain its remaining asset portfolio.

“This transaction with Sundance best meets those objectives,” said Nixon.

He further stated that upon completion of the transaction, NSE intended to continue its ongoing discussions with “other parties” to seek funding and a suitable partner for the company in its strategy to unlock the potential value in the onshore Canning and Carnarvon basins, through its Southern Canning, Laurel and Merlinleigh projects.