South Africa remains the leading foreign direct investment (FDI) destination in Africa, with a 6.9% increase in FDI projects in 2016, according to financial services advisory firm EY’s latest ‘Africa Attractiveness’ report, published on Wednesday.

The report provides an analysis of FDI investment into Africa over the past ten years. The 2016 data shows that Africa attracted 676 FDI projects – a 12.3% decline from the previous year. FDI job creation numbers declined by 13.1%.

However, capital investment increased by 31.9%.

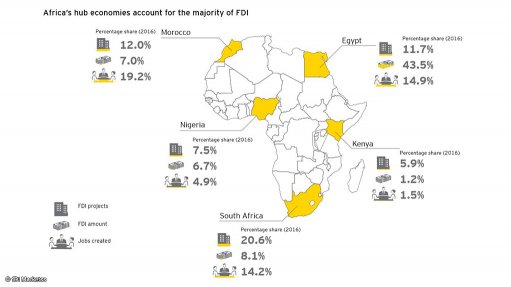

The key ‘hub’ economies, South Africa, Egypt, Kenya, Morocco and Nigeria collectively attracted 58% of the continent’s total FDI projects in 2016.

Morocco regained its place as Africa’s second-largest FDI recipient with a 9.5% increase in projects. Egypt was third, attracting 19.7% more FDI projects than the previous year.

The continent-wide surge in capital investment was primarily driven by capital intensive projects in two sectors, namely real estate, hospitality and construction, and transport and logistics.

The continent’s share of global FDI capital flows increased from 9.4% in 2015 to 11.4%.

This made Africa the second-fastest growing FDI destination by capital.

However, heightened geopolitical uncertainty and “multispeed” growth across Africa present a mixed FDI picture for the continent.

“This somewhat mixed picture is not surprising to us. Investor sentiment towards Africa is likely to remain somewhat softer over the next few years. This has far less to do with Africa’s fundamentals than it does with a world characterised by heightened geopolitical uncertainty and greater risk aversion,” says EY Africa CEO Ajen Sita.

While investors with an existing presence in Africa remain positive about the continent’s longer-term investment attractiveness, they are also “cautious and discerning”, he adds.

However, there diversification of Africa’s FDI investors is ongoing, with more than one-fifth of FDI projects and more than half of capital investment into Africa coming from the Asia-Pacific in 2016.

Most notably, Chinese FDI into Africa increased dramatically. This made the country the single largest contributor of FDI capital and jobs in Africa in 2016.

Although foreign investors still favour the key hub economies in Africa, new FDI destinations are emerging, with Francophone and East Africa becoming markets of interest, according to the report.

West Africa’s second-largest economy, Ghana, remains a key FDI market, despite recording a 31.7% decline in FDI projects in 2016 and weak growth in recent years.

The country’s improving macroeconomic environment and strong governance record have seen Ghana rise to fourth position in the EY Africa Attractiveness Index (AAI). The index was introduced in 2016, to measure the relative investment attractiveness of 46 African economies based on a balanced set of shorter and longer-term metrics.

Côte d’Ivoire also features among the top ten of the AAI. With a 21.4% increase in FDI projects in 2016, this illustrates that it is becoming a country more favoured by investors.

Senegal has also emerged as a potential major FDI destination, although this is not reflected in its current FDI numbers.

However, the country ranks eighth on the AAI, owing to its diverse economy, strong strides in macroeconomic resilience and progress in its business environment improvements.

“By 2030, Africa remains on track to be a $3-trillion economy. However, growth needs to become more inclusive and sustainable to eradicate poverty at the levels that are required.

“If we accept the reality that physical connectivity – enabled by regional integration and the development of physical infrastructure – will remain a key stumbling block to inclusive growth across Africa for at least the next decade, then the need to actively embrace digital connectivity becomes critical,” says Sita.

He avers that efforts to harness the potential of digital technologies as a fundamental driver of inclusive growth are “still far too piecemeal and fragmented”, suggesting a more collaborative effort between governments, business and nonprofit organisations to adopt technological disruption, and create digitally enabled offerings with a focus on health, education and entrepreneurship.