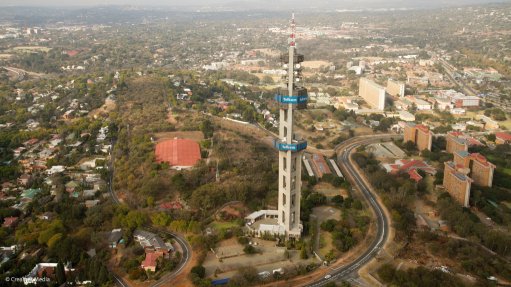

Pretoria

Photo by: Duane Daws

A few premier office nodes in some of South Africa’s major cities have registered “decent growth” during the last quarter of 2013, the latest Rode’s Report on the country’s property market showed.

Growth in nominal rentals in Menlyn, in Pretoria, at 12%, Century City, in Cape Town, at 10%, and the Sandton central business district, in Johannesburg, at 8%, had surpassed building-cost inflation of 6% during the fourth quarter under review, Rode & Associates CEO Erwin Rode said in a statement on Monday.

However, despite the boost in rental growth in Sandton, partially owing to its position as a financial hub and the ease of access through the Gautrain, the region’s high vacancy rate of 14% for grade A+, A and B combined growth could likely drag growth and impact the “huge amount” of additional planned office space.

Meanwhile, regionally, Durban decentralised showed the strongest growth at 5%, followed by Cape Town and Pretoria decentralised, with growth of 4%, and Johannesburg decentralised, which recorded growth of 3%.

Durban also gained momentum in its industrial rentals growth, with prime industrial rentals up 9% during the period under review.

“This can be compared with rentals on the East Rand, which showed growth of only 5%. In the Central Witwatersrand and the Cape Peninsula, rental growth of 2% was recorded, while in Port Elizabeth there was no growth,” Rode pointed out.

But continuing challenging conditions would “place a lid” on the demand for industrial space and keep rentals growing at moderate rates, he added.

Meanwhile, despite house prices starting the new year off with reasonable growth, continued high household debt-to-disposable income levels, slumping consumer confidence levels, the continued rise in property running costs, lackluster economic growth and its likely damper on growth in employment and disposable incomes, would likely result in modest residential rental growth in future.

“During the fourth quarter of 2013, rentals of townhouses were able to show the best yearly growth of roughly 5%, albeit from a low base, … followed by flats and houses, where rentals were up by about 3% [nationally],” Rode said.