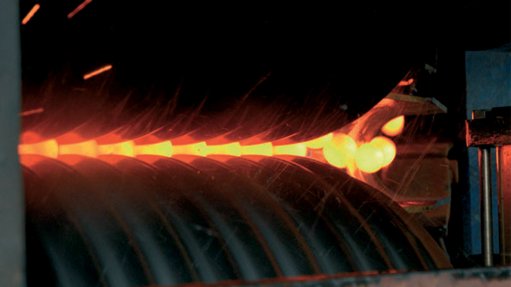

STEELY FOCUS Increased value-added beneficiation is important to ensuring the long-term sustainability of the South African steel manufacturing industry

The diversification of steel and steel products manu- facturer Scaw Metals’ baseline products and markets in key sectors will create strong growth into the immediate future, particularly in Africa, where the company has about R650-million in projects under way.

These are focused on a range of sectors, including oil and gas, mining and rail, and, Scaw says, it is actively exploring opportunities in Africa where the company already has an established foothold.

The continent, in the coming years, presents exciting opportunities. “Locally, government’s infrastructure development programme certainly should provide important demand from the local steel and construction industry, while infrastructure development in construction and rail combined with mining growth will simulate additional demand from the rest of Africa,” Scaw points out.

Outside Africa, Scaw remains focused on developing its Australia base where the company has manufacturing facilities and an extensive distribution network that also distributes products from Scaw South Africa.

The company forecasts increased demand for its “premium products” internationally, highlighting that Scaw’s strategy and expan- sion plans align the business to absorb growth both locally and internationally.

“Scaw [which is majority owned by the State-owned Indus-trial Development Corporation] lives its vision of being a South African-led globally competitive and responsible beneficiator of key raw materials into value-add steel products.”

However, it maintains that post the global financial crisis and given the significant investment in steel manufacturing capacity in China and other countries, the global steel industry will remain increasingly competitive.

With new Scaw Metals Group CEO, Markus Hannemann, the group’s strategy is focused on growing capacity and capability in the manufacture of secondary value-add steel products. “Given the tough economic climate, the strategy also recognises the need to stabilise the business on a sustainable basis as the steel industry suffers globally,” notes the company.

Scaw believes increased value-added beneficiation is important to ensuring the long-term sustainability of the South African steel manufacturing industry.

Meanwhile, Scaw plans to take advantage of government’s R4-trillion infrastructure development programme, which it says “certainly presents exciting opportunities for the local manufacturing and construction industry”.

The company notes that its strategic plan combined with its recognised capability makes it well aligned to play an important role in assisting in delivering government infrastructure projects.

In terms of government’s aim to curb scrap exports, the company says it is not too late for government to implement this plan.

“Scrap is the key input to the majority of South Africa’s mini-mills and foundry busi- nesses. The ripple effects of the export of quality scrap from South Africa have been detrimental to the local metals manufacturing industry. The resultant shortage of scrap has placed upward pressure on local scrap prices,” states Scaw.

The metals manufacturing industry is sensitive to scrap costs, says the company, as the key ingredient represents more than 50% of total cost of manufacture. Since 2009, some 100 foundries have closed in South Africa.

“Undoubtedly, the curbing of scrap exports will lead to lower scrap prices, ultimately benefiting the local metals manufacturing industry with increased competitiveness and the possibility of desperately needing growth,” highlights Scaw, adding that high steel and scrap prices hinder competitiveness.

Low scrap and steel prices beyond improving direct international competitiveness will spurt the growth of secondary manufacturing of metal products in South Africa. A competitive secondary metal manufacturing industry is vital to fuelling an efficient value-add sustainable steel industry, notes Scaw.