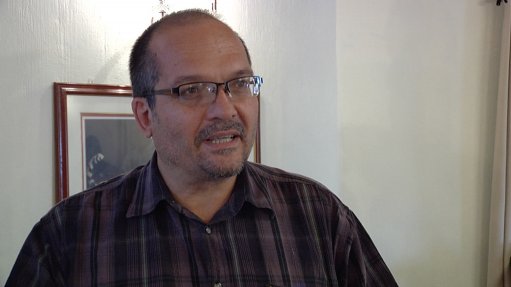

South African antenna manufacturer Poynting derives about 50% of its revenue from consumer and enterprise fixed wireless antenna product sales in Europe, including Norway, Finland, Denmark and Sweden, says Poynting founder and chairperson Dr André Fourie.

Fixed wireless network access is growing rapidly, especially in Europe and developed countries, as it provides an alternative to copper-based fixed-line connectivity. Wireless connections are easier to install, can exceed fixed-line speeds and complement other connectivity media such as fibre optics, satellite and Wi-Fi.

The company forecasts that, similar to long-term evolution (LTE) networks deployed across the world, LTE deployments in Africa will provide quicker and simpler access for many users of the Internet.

Fixed wireless connections are also being used to connect smaller villages or sites where it is uneconomical to build capital-intensive infrastructure, as the population is too small.

Fixed wireless uses fourth-generation (4G) LTE connections to provide speeds of 60 Mb/s to 100 Mb/s at low latencies. Demand for broadband connectivity is expected to double in Africa by 2020 and fixed-line and cellular systems cannot be rolled out quickly enough to meet demand.

“Europe has taught us the 4G story. Europe is a good leading indicator of what we can expect to happen in Africa. Driven by technology, the volumes of data and the connection speeds expected will require a different approach to infrastructure,” says Poynting CEO Michael Howard.

The company’s main products sold in Europe are its cross-polarised antenna solutions. Thirty per cent of all global broadband is predicted to be LTE-based by 2020, indicating stable demand, he says.

Cross-polarised antennas can receive and send two independent data streams, which significantly improves reception and transmission. Farmers were early adopters of such fixed wireless antennas, owing to their need for good connectivity, great distances and marginal mobile coverage.

Poynting is in talks with mobile service providers for the provision of such antenna solutions to enable a substantial increase in cellular base station capacity. The company’s cross-polarised antenna technology is sold as part of JSE-listed telecommunications firm Telkom’s LTE fixed wireless broadband services, boosting the data speeds and reliability that it can provide to customers from its base stations.

Poynting foresees a heterogeneous connectivity environment in the medium-term future, with mobile wireless, fixed wireless and Wi-Fi being used seamlessly to provide good-quality, uninterrupted connectivity. Fixed wireless access will support the growth of broadband connections, as fibre connections or fixed line services are uneco- nomical to deploy in some areas, says Howard.

LTE microbase stations, much smaller than conventional cellular towers, and ubiquitous Wi-Fi connectivity in densely populated areas will eventually change the landscape, allowing many machine-to-machine devices to be connected to the Internet using mobile, fixed and fixed wireless access technologies, concludes Fourie.

Poynting had been listed on the JSE, but was separated at the end of 2014. The new company, Alaris, remains listed on the bourse.