Photo by: EY

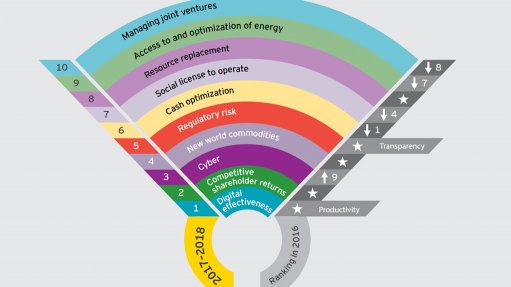

VANCOUVER (miningweekly.com) – Professional services firm EY Global revealed its annual ‘Top 10 business risks facing mining and metals’ report on Tuesday, with new entry ‘digital’ topping the list of most critical risks facing the mining industry in the coming year.

This year’s report has seen a reshuffling with digital becoming the number one priority for the sector and, as a result, cyber risk has made the jump from ninth position to third.

As companies make the move to digitising their operations in an effort to reduce costs and increase productivity, the report suggests that the industry is playing catch-up in terms of cybersecurity.

“Digitalisation of mining and metals operations has made a huge jump from ninth to third as a top-ten risk to the sector. Canadian companies that are digitising their operations in order to increase productivity and drive down costs are opening themselves up to cyber attacks – making it critical that they have appropriate protections in place,” noted EY Canada’s mining and metals leader Jim MacLean in a statement.

While the concept of digital mining is not new, EY argues that there is disconnect between the potential from digital transformation and the successful implementation of new technologies.

“We believe that digital transformation will be a critical enabler to address the sector’s productivity and margin challenges. Companies risk being left behind by their competition if they are not at the forefront of this,” advised EY global mining and metals leader Miguel Zweig.

Meanwhile, competitive shareholder returns is a new risk at number two, as it has exponentially increased in relevance over the last six months. With cash being generated at significant levels again, the level of shareholder activism in the sector is increasing on the back of the fear that it will not be sustained.

EY said that mining and metals companies need to differentiate themselves by investing capital properly and getting a good return compared with the rest of the market. “Ultimately, they need to be a leader in the market to attract capital,” Zweig commented.

Cyber risk has moved up to the number-three position as a result of increased digital transformation and the convergence of information technology (IT) and operational technology (OT), which makes companies more vulnerable to the continued rogue activity in the sector.

New in at number four is new world commodities as disruption in other sectors, particularly with increased focus on sustainability, is having a major impact on commodities. The end of petroleum cars will impact a significant part of platinum demand: almost half of global platinum production is used in catalytic converters to remove diesel pollution. Other commodities, such as cobalt, lithium and nickel, will benefit from the increased demand for battery storage.

Further, regulatory risk is new and comes in at number five, although it includes elements of transparency risk. While transparency is still important, there has been a sharp upturn in regime risk in developing countries as commodity prices improve and countries seek their fair share of improved returns.

Licensing requirements have also increased as a result of environmental accidents.

Also new to the risk radar is risk number eight – resource replacement – which needs to be addressed now to “future-proof” organisations, Zweig stated.

“With leverage across the sector significantly reduced, and cash flow improved as a result of better capital allocation and higher commodity prices, shareholders expect higher returns than the sub-5% on average over the last five years. Until these returns are met, investing for growth will remain a marginal activity rather than the central strategy that defined the first decade of this millennium,” Zweig stated.