Top risks for South Africa

The Allianz Risk Barometer 2023 shows both stability and change and with cyber incidents and business interruption ranking as the biggest company concerns for the second year in succession.

However, it is macroeconomic developments such as inflation, financial market volatility and a looming recession (up from tenth place to third year-on-year), as well as the impact of the energy crisis (a new entry at fourth) which are the top risers in this year’s list of global business risks, as the economic and political consequences of the world in the aftermath of Covid-19 and the Ukraine war take hold.

Such pressing concerns call for immediate action from companies, explaining why both natural catastrophes (in sixth place) and climate change (in seventh place) dropped in the yearly rankings, as did pandemic outbreak (from fourth to 13th) as vaccines have brought an end to lockdowns and restrictions, Allianz outlines.

Political risks and violence is another new entry in the top ten global risks at tenth, while shortage of skilled workforce rises to eighth.

Changes in legislation and regulation remain a key risk at fifth, while fire/explosion drops two positions to ninth.

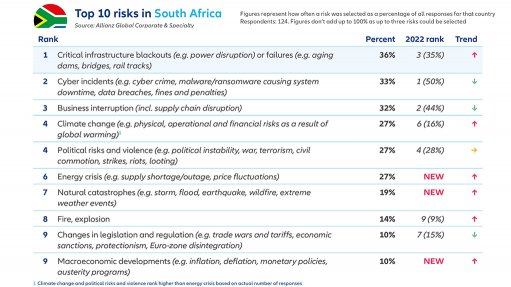

TOP THREE RISKS IN SA

Critical infrastructure blackouts such as power disruption or failures of aging dams, bridges and rail tracks, are top risks in South Africa.

Cyber incidents are ranked second and business interruption, which includes supply chain, third.

The Allianz Risk Barometer is a yearly business risk ranking compiled by Allianz Group’s corporate insurer Allianz Global Corporate & Specialty, together with other Allianz entities, which incorporates the view of 2 712 risk management experts in 94 countries and territories including CEOs, risk managers, brokers and insurance experts. Respondents were questioned during October and November 2022.

In 2023, the top four risks in the Allianz Risk Barometer are broadly consistent across all company sizes globally – large, medium and small – as well as across core European economies and the US (energy crisis excepted).

Risk concerns for businesses in Asia Pacific and African countries show some deviation, reflecting the different impact of the ongoing war in Ukraine and its economic and political repercussions.

Cyber incidents, such as information technology outages, ransomware attacks or data breaches, ranks as the most important risk globally for the second year in succession – the first time this has occurred. It also ranks as the top peril in 19 different countries, among them Madagascar, Mauritius, Morocco, France, and the UK. It also ranks as a top three risk in South Africa, Kenya, Nigeria, and Tanzania. It is the risk that small companies are most worried about.

For businesses in many countries, 2023 is likely to be another year of heightened risks for business interruption (BI) because many business models are vulnerable to sudden shocks and change, which in turn impact profits and revenues.

Ranking second globally and in Africa and the Middle East, BI is the number one risk in countries such as Cameroon, Brazil, Germany, Mexico, Netherlands, Singapore, South Korea, Sweden and the US.

A possible global recession is another likely source of disruption in 2023, with potential for supplier failure and insolvency, which is a particular concern for companies with single or limited critical suppliers.

MACROECONOMIC MALAISE

Macroeconomic developments such as inflation or economic and financial market volatility rank as the third top risk for companies globally in 2023 (25%), up from tenth in 2022 – the first time this risk has appeared in the top three for a decade.

It is also a new entrant in South Africa at tenth, and features in the top three risks in Burundi, Ghana, Ivory Coast, Madagascar, Mauritius, Morocco, Namibia, Nigeria and Tanzania.

All three major economic areas – the US, China and Europe – are in a crisis mode at the same time, albeit for different reasons, according to Allianz Research, which forecasts recession in Europe and the US in 2023.

Inflation is a particular concern as it is ‘eating’ into the price structure and profitability margins of many companies. Like the real economy, the financial markets are facing a difficult year, as central banks drain excess system-wide liquidity and trading volumes even in historically liquid markets decline.