Policymakers and donors on the continent need to play a more active role in enabling credit markets to open up in a positive way, a new research report by Financial Sector Deepening Africa (FSD Africa) states.

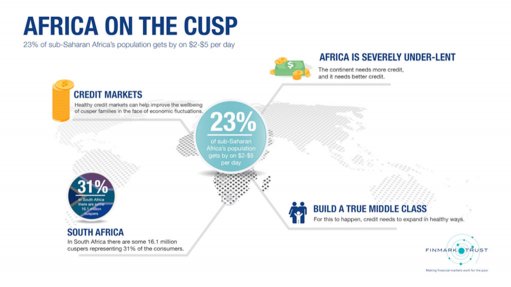

The report added that Africa was “severely under-lent” and needed more and better credit.

According to the report, a new class of consumers referred to as the “cusp group” is emerging in sub-Saharan Africa. This group accounts for 23% of sub-Saharan Africa’s population, covering a segment of active earners that straddle the formal and informal worlds and get by on $2 to $5 a day.

In South Africa, there are some 16.1-million "cuspers" representing 31% of consumers. For this group, healthy credit markets could expand opportunity and enable upward mobility, helping to build a true middle class. However, for this to happen, credit needs to expand in healthy ways.

The research reveals that, in South Africa, consumer lending to cuspers is extensive, aggressive and highly formalised. However, Cuspers borrow to display their wealth, while lenders compete to extend seemingly lucrative loans to cuspers whose jobs are uncertain and who have tight budgets. With bad loans mounting, lenders are forced to restructure and are stuck with overextended balance sheets.

Still, the market is failing to self-correct.

Yet, as a result, many of the tools that make a credit market work are already in place: suppliers are incentivised to expand their outreach, cost effective income verification is available for the large formally employed sector, credit information sharing is highly sophisticated, and there is a specific regulator watching credit market conduct and monitoring consumer debt.

Given the major shifts taking place in African economies, credit markets play an important role in shaping the destiny of cuspers. Healthy credit markets could help improve the wellbeing of cusper families in the face of economic fluctuations.

It is expected that the report findings will inform regulators, donors and lenders, enabling them to take note of shifting demographics and the key importance of the cusp group as a market, political force, and as the future middle class.