The value of 'benchmarking' your industrial systems and processes using 'RECP'

This article has been supplied as a media statement and is not written by Creamer Media. It may be available only for a limited time on this website.

Ai2SA hope to illustrate to industrial clients why it’s beneficial to perform “independent benchmarking” of their Industrial Systems and Processes based on the “Resource Efficiency Cleaner Production” (RECP) principles introduced by the Department of Trade and Industry (DTI) initiative, the National Cleaner Production Centre of South Africa (NCPC-SA). RECP subsequently considers optimal use of resources (raw materials, energy and water) along with the reduction of waste and while not always the case RECP assessments leads to a review of the Energy (all forms) Management System (EnMS) and subsequent implementation of some form of Energy Systems or industrial systems optimization (ESO). Envisaged savings are found to be +/- 10 to 25%, (payback < 2yr). See www.NCPC.co.za for some independent case studies.

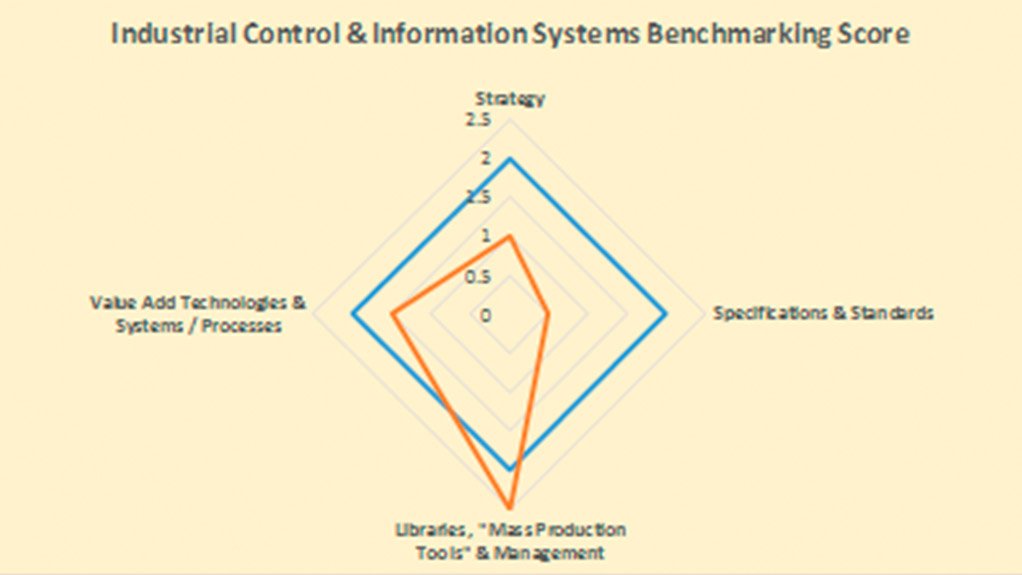

Benchmarking (the process industry leaders use to compare key parameters of its business to that of its peers) traditionally does not extend to include “maturity” of industrial Control & Instrumentation (C&I) along with supervisory system(s) known as Programmable Logic Controllers (PLC’s) and Supervisory, Control and Data Acquisition (SCADA), nor Management Information or other value add Systems (e.g. MIS, etc.). Traditionally often suppliers merely attempted to “move boxes” and didn’t always consider client’s “cycles” or phases (e.g. building / operating / growing / declining, etc.) clients finds itself in however given global downturn every supplier has to ask itself how it can add value to its clients by either driving costs down or profits up.

Looking at it it’s evident that the objective is to improve client’s margins, quality and response times and that initially some of the interventions (red triangles) should be possible to be implemented without (significant) upfront capital following “RECP” savings realized. We realize various “barriers” exist in that clients are busy and may not have the capacity to implement solutions so hope projected savings will assist in motivating some of the considerations / recommendations listed within.

External (macro) variables such as legal, economic, and technological aspects, etc. has a direct impact on a client’s sustainability and hence the 1st intervention to be considered is for client’s to perform ongoing proactive research into these and in terms of technology it is either up to client’s internal resources or that of a 3rd party. Doing so will lead to the client identifying both possible risks along with opportunities allowing for more proactive strategies to be developed to mitigate risks and capitalize on for instance technological advances / trends e.g. Internet of Things (IoT), etc.

Clients enter the “plan phase” associated to a typical facility lifecycle which is also the point at which most value may be created by performing accurate feasibility studies, etc. Should it be found viable the client would proceed to “build phase” to setup new operations or additional machines / lines, etc. Significant savings may be realized using “mass production tools” to for instance reduce time and associated costs to produce designs / software and hence it is advisable for client to have up to date standards and specifications in place. It is also advisable to manage this phase properly to ensure in scope, time and cost delivery to specified standards and that project actually meets its preset objectives.

During “production (run) phase” various additional “value add” technologies / principles may be considered to further enhance production to assist in achieving the listed objectives (increase profits). Note clients may either be growing / declining or just “ticking over” in terms of “net profit”. Overall across the life cycle of the facility other interventions may also be considered to add value to the organization e.g. “change control”, etc.

It is hence imperative that clients consider the RECP principles across the total lifecycle of the facility. RECP considers interventions in following six (6) areas in order to achieve its objectives namely: 1.) “housekeeping” (e.g. training operational personal, establishing procedures, etc.), 2.) Substitute / reduce “inputs” (e.g. Energy by performing regression analysis to determine top significant energy users (SEU) vs. key drivers, raw materials, EnPI’s, etc.), 3.) internal re-use / recovery of “by products”, 4.) modification of outputs (e.g. what is produced), 5.) make use of the industrial symbioses program (IPS) sending waste to others that may use it and only then finally 6.) introduce new technology (e.g. processes / equipment) so only at this stage does value add technologies (which may require capital) get considered. Prior to this objective is to try and identify ways to leverage RECP principles ideally without 1st spending capital upfront and then only once savings are realized to apply the savings to effect more changes. Grants, tax incentives, funding and other models do exist in line with various Green Economy initiatives.

Clients are urged to consider “clustering” (based on value chains / knowledge areas, etc.) as introduced within respective frame works such as the National Developmental Plan (NDP), Industrial Policy Action Plan (IPAP) along with others and possible spin offs being created by these formal plans and to align / rally behind them. The aforementioned requires for businesses to work closer together across the complete value chain in order to leverage critical mass and economies of scale which has the added benefit of promoting ‘localization”

In line with “benchmarking” we have developed a questionnaire and hope it can assist clients with rating themselves in terms of how they fair against their peers.

For us to be able to predict your savings we would need to follow the RECP methodology, requiring relevant information to perform the required NPV calculations to determine payback period, etc. Some overhead costs may be associated to assist with such an RECP intervention however profit sharing and other models exist.

Petrus.Klopper@Ai2SA.co.za / +27 82 559 7437

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation