Brexit set to change SA’s bilateral economic relationship with the UK

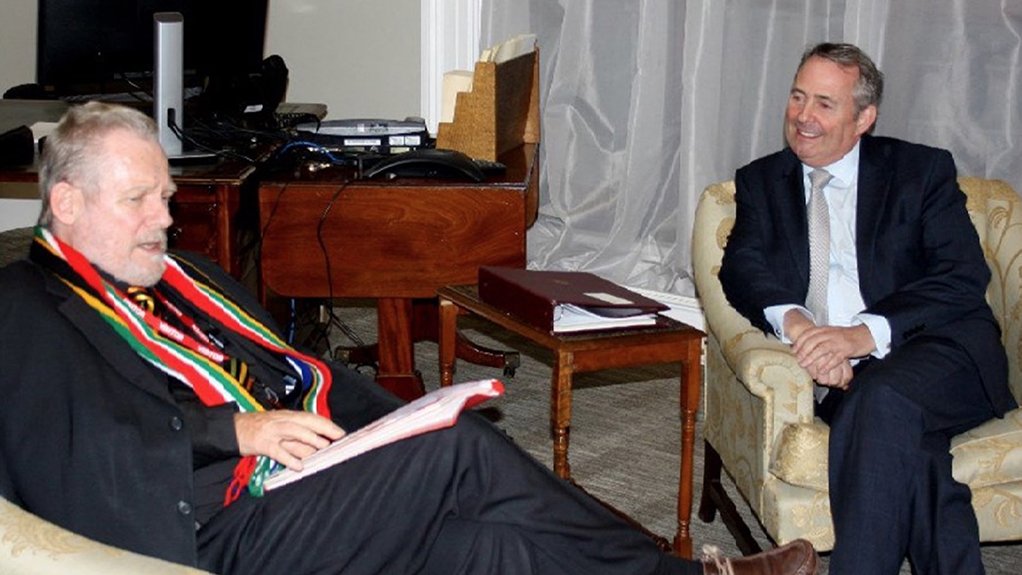

IN-PRINCIPLE UNDERSTANDING South African Minister of Trade and Industry Dr Rob Davies meets with UK Secretary of State for International Trade Dr Liam Fox

Photo by Crown Copyright

OPPORTUNITY 2 South African manufacturers could, post-Brexit, compete with both British and EU manufacturers

Photo by Duane Daws

OPPORTUNITY 1 The South African government is interested in increasing citrus exports to the UK

Last month, during the debate regarding the 2017 State of the Nation address in Parliament, in Cape Town, Trade and Industry Minister Dr Rob Davies highlighted: “[A]s the UK government prepares to trigger exit negotiations from the EU (European Union), we need to prepare for a new trade arrangement with the UK. We have been engaged with the UK government and reached an in-principle understanding that there will be no damage to existing trade and investment relations that must be preserved. We also agree that the legal commitments under the EPA (Economic Partnership Agreement) with the EU, including the UK, will continue to be the basis for our bilateral trade in the immediate future and that those commitments would be carried over into any new arrangement in future. We will have to pay particular attention to questions of how quotas, notably on agricultural products will be dealt with to avoid any damage to current trade.”

On January 24, Davies held talks in London with the UK’s Secretary of State for International Trade, Dr Liam Fox. According to the official statement released by the UK Department of International Trade (DIT), the two Ministers discussed the current bilateral trade links and the opportunities to increase these and both affirmed their commitment to work together to augment these relationships and identify and develop trade and investment opportunities that would benefit not only both countries but also Southern Africa and Africa.

“The UK is a historical and strategic trade and investment partner for South Africa and remains a key market especially for agriculture exports accounting for over 20% of South Africa’s exports of wine and 30% of fruit exports globally,” pointed out Davies in his official statement after the meeting. “The UK is the biggest destination in the EU for South African investment, accounting for 30% of South African investments into Europe. Further, 46% of South Africa’s global investment originates from the UK. We must ensure that we have a predictable trade and investment environment for mutual benefit for both parties. As we work to achieve this, South Africa looks forward to discussing how our trade post-Brexit (British exit from the EU) could build on the recently concluded EPA with the EU.”

“South Africa is a key trading partner to the UK – a long-standing, strong and strategic ally for the UK in Africa and internationally,” assured Fox in his statement. “It is our largest export market in Africa; the largest economy in the Southern African region and a fellow G20 (Group of 20 leading economies) member. South Africa was also the largest recipient of UK foreign direct investment (FDI) in 2014 – a value of £13.1-billion. As we become an even more outward looking country, we will continue building on our relationship with South Africa and today’s meeting was an opportunity to discuss how we progress that.”

The importance London gives to trade and investment relations with South Africa had already been shown by the fact that this country was the first to be visited by UK Chancellor of the Exchequer (Finance Minister) Philip Hammond in early December. The other two countries visited on that initial trip were Japan and South Korea, putting Pretoria in august company. According to the UK Treasury statement issued at the start of this tour, this and future such trips were and would be intended “to showcase the UK’s commitment to forming even stronger global ties as we prepare to leave the EU”.

Figures and Framework

According to the US Central Intelligence Agency’s free-access reference The World Factbook 2017, the UK had an estimated gross domestic product (GDP) of $2.65-trillion (in exchange rate terms) during 2015, being the fifth- or sixth-largest in the world, depending on the strength of the pound sterling. In purchasing power parity (PPP) terms, its GDP was $2.788-trillion last year, ranking it ninth in the world (after China, the US, India, Japan, Germany, Russia, Brazil and Indonesia). UK PPP GDP per capita was $42 500. The structure of the British economy is: agriculture, 0.6%; industry, 19.2%; and services, 80.2%. Services encompasses a lot more than financial services, for which the City of London is famous. According to a UK House of Commons Briefing Paper, in 2014, the financial and insurance services sector provided £126.9-billion in gross value added (GVA) to the UK economy, or 8% of total GVA. (GVA is equal to GDP plus any subsidies on products or services, minus taxes on those products and services.)

According to The World Factbook 2017, South Africa’s exchange rate-based GDP in 2015 was estimated at $280.4-billion and its PPP GDP for last year at $736.3-billion. South Africa was ranked 30th in the world – and third in Africa, after Egypt and Nigeria. PPP GDP per capita was estimated at $13 200 last year. Last year, agriculture accounted for 2.2% of the national economy, industry for 29.2% and services for 68.7%.

According to the UK DIT, trade between the two countries came to £8.1-billion in 2015. British exports of goods and services to South Africa have increased by 25% over the past ten years. South Africa is the UK’s number three trading partner within the Commonwealth.

The situation of the UK with regard to global trading arrangements, as embodied in the World Trade Organisation (WTO), was made clear by the country’s ambassador and permanent representative to the United Nations and other international organisations in Geneva, Switzerland, Julian Braithwaite, in an official blog in late January. “The UK is a full and founding member of the WTO,” he wrote. “We signed and ratified the 1994 Marrakech Agreement that established the organisation . . . Under the EU treaties, member States have agreed that the European Commission will represent them on most things in the WTO. As a full member of the WTO, the UK has its own seat . . . But for most WTO business, the Commission speaks for all of us collectively. Establishing the UK’s separate position in the WTO is not simply a matter of starting to speak up for the UK from one day to the next. “Every WTO member State has things called schedules, lists which set out their commitments – their rights and obligations – in the international trading system. These cover trade in both goods and services. WTO legal experts will tell you that, as a full member, the UK already has its own schedules. But, at the moment, these are shared with the other EU member States. Smoothly separating the UK from the EU schedules is the best way we can reassure our WTO partners that their trade with us will not be disrupted as we leave the EU . . . A country’s WTO schedules also provide the baseline for negotiating bilateral free trade agreements . . . [W]e plan to replicate our existing trade regime as far as possible in our new schedules . . . Replicating our current EU trade regime will help ensure that our transition in the WTO is as simple, technical and uncontroversial as possible. It, by no means, precludes the UK from taking control of its trade regime after we leave the EU, and shaping it in the interests of the British economy and the global trading system. Indeed, it is a necessary precondition for doing just that.”

Challenges and Opportunities

Nevertheless, there will be challenges as well as opportunities for both countries arising from Brexit. “The challenges are, if Brexit does harm Britain and Britain’s economy, it would damage a major South African export market,” points out Econometrix director and chief economist Dr Azar Jammine. “And the fall of the pound sterling against the rand has increased the cost of South African products in the UK. On the other hand, if there is a ‘hard Brexit’, the UK may redirect trade towards traditional Commonwealth partners, like South Africa. The UK is already the biggest investor in South Africa.”

Jammine reports that agriculture accounts for only 2.2% of South Africa’s GDP, which means that the UK leaving the EU’s Common Agricultural Policy and probably becoming more open to agricultural imports would have a limited impact on the South African economy as a whole. “Manufactured goods exports and services exports are much more important for South Africa,” he highlights. “This is where the opportunities exist. We can compete, in manufacturing, with both British and European competitors.” There is, thus, a double opportunity for South African business, post-Brexit: to compete with EU manufacturers in the UK and to compete with UK manufacturers in the EU market.

“To sum up, the UK could be much more interested in South Africa than it has been since joining the EU,” he observes. “But, if Brexit significantly harms London as a financial centre, that would indirectly harm South Africa.”

“With the UK embarking on a more global and open trading approach post-Brexit, there is every reason to be confident that SA-UK trading relations will prosper,” affirms British Chamber of Business in Southern Africa CEO David Dawson. “The trading relationship is already historically, strategically and currently important and our respective Ministers have committed to strengthening ties. The two countries will work together to identify trade and investment opportunities that will benefit not only the UK and South Africa but also the wider Southern Africa and Africa region. As a business chamber whose members comprise both UK and South African companies, we are confident of good collaboration going forward as the UK is free to enter into bilateral agreements with old friends and new.”

Unsurprisingly, given Fox’s comments after his meeting with Davies, the DIT has categorised South Africa as one of 50 key markets that the UK wants to strengthen its trade relations with. (This categorisation predated the Davies-Fox discussion.)

“The starting point is that we do have a long and diverse trading relationship between South Africa and the UK,” stresses DIT trade director: Southern Africa Emma Wade-Smith. “We are not starting from scratch. Hundreds of South African companies are operating in the UK and using the UK as their overseas base. Hundreds of British companies are doing the same in South Africa, especially with regard to the rest of the continent. Brexit doesn’t change any of that. Given that the British government is committed to free trade, I expect that it will give more impetus to developing the [business] relationship. The UK government is extremely pro-business; the [Brexit] negotiations will be designed to achieve the most friction-free trading relationship with the EU. It is in everyone’s interests to achieve the best possible relationship, post-Brexit.”

She emphasises that her office, in Johannesburg, exists to help both British companies seeking to come to South Africa and South African companies seeking to enter the UK. She notes that UK companies entering South Africa now often do so in partnership with South African companies. The British government believes that there are certain sectors in which UK companies can make particularly valuable contributions to the South African economy. These include agritechnology, aerospace, defence and security, financial services and fintech, health-care infrastructure, infrastructure more broadly (particularly railways, including light rail solutions for urban transport), mining, and technology and innovation.

Wade-Smith points out that the British government has already identified its Brexit negotiating priorities. These include Whitehall’s desire to provide as much clarity on the process as possible, the intent to phase in transitional arrangements to avoid Brexit becoming a “cliff edge”, and the need to prevent any disruption in existing trade relationships. London has also affirmed its intent to enhance the UK’s trading relationships outside the EU.

“It is very encouraging that the South African government wants to talk to us and we want to talk to them about our future trade relationship,” she affirms. “The important point is the consistent message from the South African government about the importance of our trade relationship and that Brexit won’t disrupt it and might provide greater opportunities. Brexit does provide the opportunity to take a fresh look at our trading relationship. The South African government is, for example, interested in increasing citrus exports to the UK.”

Delivering a speech in Toronto, Canada, near the end of January, Fox highlighted that “[e]nsuring that there is no disruption of our free trade . . . is a top priority for my department . . . [I]f we are to champion free and open trade, the UK must reforge our relationships with those nations who have been our longest-serving and closest allies . . . Britain will stand in defence of free trade, working with partners and allies . . . There is a big, wide world for Britain to do business with, and we intend to do just that.”

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation