Platinum price fall worsening plight of job-intensive mines

JOHANNESBURG (miningweekly.com) – The latest fall of the platinum price is threatening to become the last straw that broke the camel’s back for some deep labour-intensive platinum group metals (PGMs) mines on particularly the western limb of the Bushveld Complex, Mining Weekly Online can today report.

Well ahead of the latest price decimation, platinum company CEOs were expressing concern about the lossmaking position of western limb PGMs mines, which account for 55% of South Africa’s platinum production and provide 136 000 direct mining jobs.

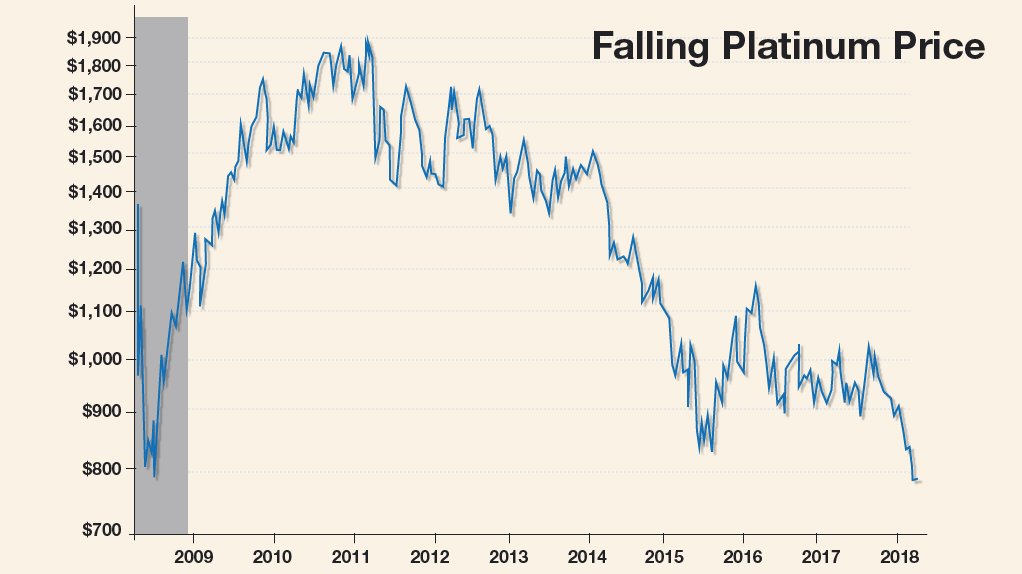

At the time of going to press, the platinum price was $801/oz, which even rand conversion is unable to embellish to an acceptable level. As long ago as February 2012, the then Anglo American Platinum CEO, Neville Nicolau, was unequivocal about $1 900/oz being essential for the capital investment required to maintain long-term production.

While the current record price of palladium is a major plus, the benefit this provides is significantly eroded by the woes of platinum, which contributes 58% to the western limb’s overall PGMs basket, compared with palladium’s 32%.

Even when account is taken of all six PGMs, observers closest to the metals are advocating strategic intervention in order to provide more effective management of the PGMs commodity cycle in the interests of preserving what is a national patrimony.

As one observer remarked to Mining Weekly Online this week, if the western limb mines collapse, so does the economy of the North West province.

Some would like to see strategic funders form the core of a PGMs development coalition, which will require long-term sovereign wealth fund-type capital to coordinate investment across the value chain to ensure the uptake of mined production.

It is seen as being important to create mechanisms that provide global partners with security of platinum supply, while, on the local front, the Precious Metals Act of 2005 empowers a regulator to promote access to precious metals for local value addition.

In the late Seventies and early Eighties, my interviews with platinum-mining executives invariably centred on marketing, which platinum needs. The executives of that former platinum fortress, Johannesburg Consolidated Investments, would, on each occasion, provide insight into the development of platinum-catalysed fuel cells.

Mining Weekly Online is thus in full agreement with Mining Phakisa coordinator Edwin Ritchken, who writes in the book The Future of Mining in South Africa: Sunset or Sunrise, just published by the Mapungubwe Institute for Strategic Reflection: “The market for PGMs needs to be continuously developed as there is no ‘natural’ global demand for the metals – demand is derived through a continuous process of PGM-based technology development and commercialisation.”

In Chapter 3 titled, 'A Vision for South Africa’s PGMs, the Gold of the 21st Century’, Ritchken emphasises the need for a commodity-specific vision for each metal within the PGMs cluster of six metals – platinum, palladium, rhodium, osmium, ruthenium and iridium – which occur together in nature alongside nickel and copper.

In addition, he adds, South Africa requires a nationally driven effort to generate sustainable demand for the metals, which will, in turn, require an enabling policy and regulatory environment.

As a core component of the hydrogen economy, fuel cells are the most likely technology to make up for the downturn in PGMs demand, resulting from the projected increased use of electric vehicles.

The competitiveness of stationary fuel cells is said to be slowly benefiting from the increased cost of alternatives and there are reportedly a number of fuel cell technologies that are being commercialised, which will be followed by the cost reductions associated with the manufacturing and design learning curve.

Ritchken sees it as important for South Africa to catch the wave of projected increased fuel cell sales, which mining companies can themselves promote by using fuel cell equipment in their mines.

“The PGMs mining sector is at a watershed moment. It is facing declining platinum demand at precisely the time when the sector has limited resources to invest in application and market development and commercialisation,” he says, while concluding that nationally driven effort will ultimately be required to give the industry legs.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation