Mozambique Area 1 liquefied natural gas facility, Mozambique – update

Photo by TotalEnergies

Name of the Project

Mozambique Area 1 liquefied natural gas (LNG) facility.

Location

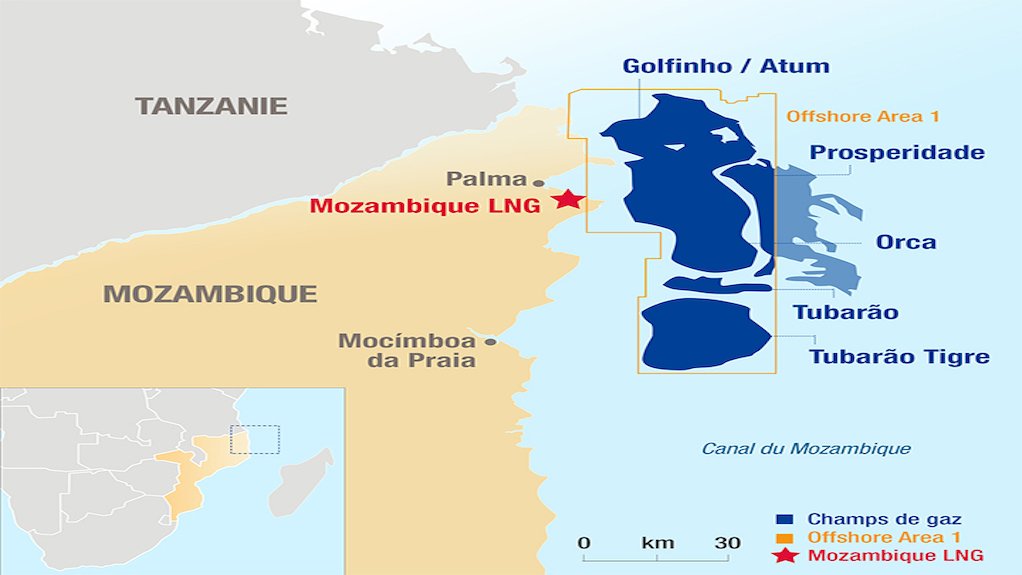

The project proposes to develop an LNG facility on the Afungi peninsula in Cabo Delgado province, Mozambique.

Project Owner/s

Total E&P Mozambique Area 1 Limitada, a wholly owned subsidiary of TotalEnergies, operates Mozambique LNG with a 26.5% participating interest, alongside ENH Rovuma Área Um (15%), Mitsui E&P Mozambique Area1 Limited (20%), ONGC Videsh Rovuma Limited (10%), Beas Rovuma Energy Mozambique Limited (10%), BPRL Ventures Mozambique (10%) and PTTEP Mozambique Area 1 Limited (8.5%).

Project Description

Offshore Area 1 contains about 65-trillion cubic feet (tcf) of recoverable natural gas.

The project involves the development of Mozambique’s first onshore LNG facility comprising two initial LNG trains with a total nameplate capacity of 13.1-million tonnes a year to support the development of the Golfinho/Atum field, located entirely within Offshore Area 1.

A total of 18 tcf will be developed in the first two phases.

The project has scope to increase production to 50-million tons.

Gas from the Anadarko-operated offshore field will be sent to an onshore processing plant, where it will be liquefied and then exported.

Potential Job Creation

Area 1 has about 5 000 workers on site, progressing works associated with the construction of a resettlement village, camp expansion, an airstrip and the Palma-Afungi highway.

Capital Expenditure

$25-billion. The project will be funded using $11-billion of equity and $14-billion of debt.

Planned Start/End Date

A final investment decision was announced in June 2019. The project was halted in 2021 following insurgent attacks on civilians.

At this time, there is no date set for the restart of construction on the project.

Latest Developments

Banks and other financiers should withdraw their support for the Area 1 project, environmental lobby groups have urged in a letter sent on November 17 to more than two dozen project funders.

The letter, seen by Reuters, comes at a crucial juncture for the French energy company as it prepares to relaunch Africa's biggest foreign direct investment project.

Activists warn that the project might worsen climate change and fuel human rights abuses in Mozambique.

"As a critical financial supporter of the project, you bear a direct and important responsibility in its dreadful impacts," the letter, supported by more than 100 organisations, including ActionAid International and Greenpeace France, states.

Lawmakers in the Netherlands said in October 2023 that they would insist on being consulted on safety and human rights concerns before they can approve a €1-billion ($1.06-billion) loan guarantee for the project, which has stalled since April 2021.

Welcoming the Dutch decision as an important signal, private finance campaigner with Friends of the Earth France Lorette Philippot said activists are "hopeful that other financiers will conduct proper assessments and withdraw from this time bomb project".

TotalEnergies has previously said arrangements for project finance remain in place despite a 'force majeure' halt in 2021, when Islamist militants threatened the project site.

Financing agreements for the project were struck in 2020 with direct and covered loans from eight export credit agencies, 19 commercial banks and the African Development Bank (AfDB).

An estimated $15-billion in financing is being reviewed as part of restarting procedures, according to a credit official familiar with the current negotiations.

South Africa's Export Credit Insurance Corporation plans to seek board approval in early 2024 to support the project, according to acting CEO Ntshengedzeni Maphula.

The project delay has led some investors to reassess their previous cost assumptions in light of inflation and global gas market swings.

The US Exim bank, which is guaranteeing $5-billion, has said it is conducting due diligence on plans to resume construction.

Key Contracts, Suppliers and Consultants

TechnipFMC, through its subsidiary FMC Technologies (subsea trees, completion workover riser and installation workover control system, subsea controls system, subsea connectors and production manifolds); TechnipFMC, through its subsidiary Technip Mozambique and Oceaneering International (aftermarket services in Mozambique); Oceaneering International (subsea umbilicals and distribution hardware); Advanced Technology (pipeline subsea ball and subsea gate valves); Cameron Italy (subsea chemical injection metering valves engineering, procurement, construction and installation (EPCI) for the offshore subsea system); TechnipFMC and VanOord (EPCI of the offshore subsea system, engineering, procurement and construction (EPC) for the LNG facility and support facilities); and McDermott, Chiyoda and Saipem (EPC contracts for the Mozambique LNG liquefaction facility and support facilities).

Contact Details for Project Information

Total E&P Mozambique Area 1 Limitada, tel +258 21 500 000 or email tepma1.communication@total.com.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation