ECIC plays a pivotal role in Sub-Saharan Africa with 15 years of Project Export Excellence

The creation of ECIC began 15 years ago, in July 2001, when the Export Credit Insurance Corporation of South Africa LTD (ECIC), was given a mandate of filling a market gap through provision of medium to long term export credit and investment guarantees by underwriting bank loans for political and commercial risk insurance cover, on behalf of the South African government.

For more than forty years, up until 2001, all export reinsurance requirements fell to the Department of Trade and Industry and the Credit Guarantee Insurance Corporation of Africa Limited. When the private sector entered the export credit market, the short-term transaction market was amply catered for, but medium to long-term export transactions still had a need for a dedicated export credit agency, which was when the ECIC was established. Acting as an ëinsurer of last resort', the ECIC steps in when commercial lenders are either unwilling to accept long-term risks or unable to. While the ECIC is part of a broader government policy, it remains an independent limited liability company but with the government as its sole shareholder and is enabled under the amended Export Credit and Foreign Investments Insurance Act of 1957.

Export credit is imperative since the nature of capital exports is that they are long dated assets. It is customary for firms to

finance such exports with bank debt for cash flow management purposes. Export credit financing is therefore an important and key aspect of international trade. Access to competitively priced export credit creates the ability for our local contractors to bulk up and compete more effectively in foreign markets. With the ECIC in support of such transactions, the South African export market is enabled and contractors become more credible.

This has a far-reaching impact on fostering a stronger economy and drives domestic job creation, contributions to fixed capital formation and the GDP, as well as the generation of fiscal revenue.

From ECIC's perspective we underwrite bank loans for financing of the export of South African capital goods and services. The sectors that benefit the most are mining, power, oil and gas, defence, aviation, transportation and other infrastructure. While mining projects constitute about 36 percent of our portfolio, we have extensively supported the agriculture and energy sectors, specifically projects in Mozambique, Sierra Leone, and Ghana. The bulk of our portfolio at almost 90 percent is in the sub-Saharan region with Ghana 21.7 percent, Zambia 19.9 percent and Zimbabwe 12.7 percent. Our strategy is to grow our insurance footprint on the continent to be the preferred insurance partner.

We see Africa as a natural base for the ECIC. Our current marketing reach is focusing increasingly on East and West Africa. The African continent is well endowed with mineral resources. The commercial exploitation of these resources requires access to transport infrastructure to get the products to market. The project sponsors who drive these projects have to include the infrastructure costs into the overall project costs. In as much as the project viability depends on access to infrastructure, likewise, the commercial viability of the infrastructure relies on the sustainability of the revenues that the project will generate, to pay off the financiers.

In an environment where there are fiscal constraints due to the economic downturn, collaboration between the private sector and public sector players becomes critical to get transport projects off the ground. Where the transport corridor runs through a number of countries, the level of co-operation and coordination is very paramount. These challenges underscore the importance of a regional strategy and framework for a more integrated transport development plan.

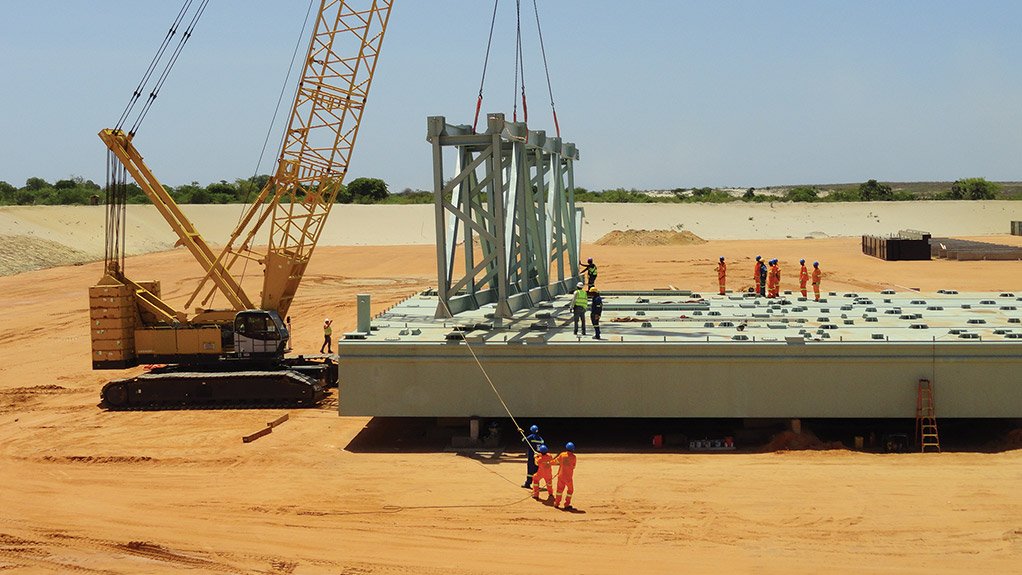

ECIC is strategically positioned as a key player in facilitating the availability and affordability of long term finance to unlock the development potential of the big plans being converted into tangible and realizable projects. ECIC is also involved in the long term financing of the Nacala transport corridor which runs through Malawi to the Nacala port in Mozambique. Through our political and commercial risk insurance, we are able to crowd in long term finance and meaningful tranche of debt to help the project sponsors to increase the level of gearing for their projects and to blend in diverse sources of finance.

ECIC support extends beyond the financing of the transport network and encapsulates the support for the rolling stock as well. In Sierra Leone, and working in partnership with Standard Bank, we have provided critical support to Grindrod to enable them to supply locomotives and wagons to the Tonkololi mine.

This is a good example that infrastructure projects can be a catalyst for industrial development by increasing investment into our domestic manufacturing sector and also serves to facilitate export trade. This type of project resonates with the mandate of ECIC to facilitate export trade between South Africa and the rest of the continent, with a clear industrial development agenda that is mutually beneficial to our economy and the host countries. Sudan is one of the countries where ECIC paid its school fees and had to settle a claim linked to the supply of locomotives. However, more recently, we have continued to support rail locomotives in places such as the DRC, Zimbabwe and Zambia and we expect to support more projects in this sector.

Our comprehensive cover includes political and commercial risk insurance which insulates the banks and our financiers against country risk and payment default. The exporter may also benefit from the return of asset cover that ECIC provides, especially where the rolling stock is supplied through a lease structure or via an instalment sale agreement where ownership only passes on full payment.

Export credit insurance is unique and traditionally offered by official export credit agencies backed by their national treasuries. Potential exporters need an enabling environment to successfully tender on capital projects that require significantly large

financial packages. With the cost of finance further impacted on by a range of factors including sovereign ratings, which in South Africa's case, is in the lowest bracket of investment grade, exporters need a boost to remain as equally opportunistic as their international competitors. The interest on ECIC backed loans is benchmarked on the Commercial Interest Reference Rates (CIRR), which is determined by the Organization for Economic Cooperation and Development or the Libor, which is the benchmark rate that the leading global banks charge among themselves for short-term loans.

Along with our major shareholder, the Department of Trade and Industry, we make use of market research tools and our separate business development units to deve-lop new insurance products that are in line with the government's export promotion policy objectives. Performance Bond insurance cover, which we launched last year, is one such example. Currently we are working on covering credit lines and return of plant and equipment. We also continue to motivate for the release of increased lending capacity by financial institutions by entering into agreements with other ECAs. In this way we create a framework for re- and co-insurance, such as we are doing with sister BRICS ECAs with which we recently adopted a comprehensive plan of action aimed at actualizing cooperation programmes for mutual benefit.

Our vision and mission is a commitment to sustainable business growth through innovative products, operational excellence, business development and strategic partnerships. In enabling frontier markets to optimize production we are motivating a positive socio-economic impact. Through our association with the Africa Investment and Integration Desk (AVID), we strive to unlock investment opportunities that might otherwise be difficult to realise. AVID, a NEPAD structured foundation, assists financiers and investors to overcome bottlenecks in the process of project investment and development.

Country-scoping visits are undertaken regularly to ensure that we are in the space of identifying new investment opportunities as they birth, and in particular those nations that are emerging from years of conflict, such as South Sudan and Eritrea, countries that are in the process of rebuilding and developing much needed infrastructure.

Further to this, we aid in narrowing the skills gap with a number of initiatives related to education, skills development and volunteerism. Beneficiaries have included Penreach in Mpumalanga, the Rehoboth Trust in KwaZulu-Natal, the Maths and Science Leadership Academy in the Northern Cape, and DeafSA in Limpopo.

Given that the ECIC is an African-based and structured organisation, we are best placed to understand the dynamics of the problems our leaders, financiers and investors face. We therefore play an important role in addressing obstacles through facilitation, and by aiding in the release of funding required for the construction of infrastructure, which as we all know is of particular concern to international companies seeking to have an African presence. We are also able to price African risk more effectively given our indigenous status even though demands are universally similar. Ideally what we ensure is the provision of cost competitive cover and the honouring of claims when they arise. Further to this, we are dedicated to deepening regional

integration by encouraging diversification of the domestic industrial base so that nations can tap into the increasing demand of a growing middle class consumer base.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation