Bank flags metal price weakness as key risk to Africa’s 2015 outlook

A further decline in the already depressed price of metals – particularly iron-ore, gold and copper – would severely affect a large number of countries in sub-Saharan Africa, the World Bank’s latest Global Economic Prospects (GEP) report warns.

The authors still expect the global economy to grow by 3% in 2015, up from 2.6% last year, and for the region to expand by 4.6%, with South Africa expected to growth far more slowly at 2.2%.

However, they warn that lower growth in emerging economies, to which sub-Saharan African countries export, is a major external risk. “A worse-than-expected slowdown in China, especially, would reduce demand for commodities, putting further downward pressure on prices, especially where supply is abundant.”

China consumes almost a quarter of global energy output and a half of global metal supply, but as its economy has slowed prices of metals such as copper, iron-ore and nickel have fallen to more than 30% below their 2011 highs. The report expects these prices to stay low during 2015 and 2016 as expanding supply is only gradually absorbed by rising demand.

Any protracted decline in metal prices, however, would lead to a significant drop in export revenues, as well as a scaling down of operations and new investments, which would reduce the growth momentum in a number of African countries for an extended period.

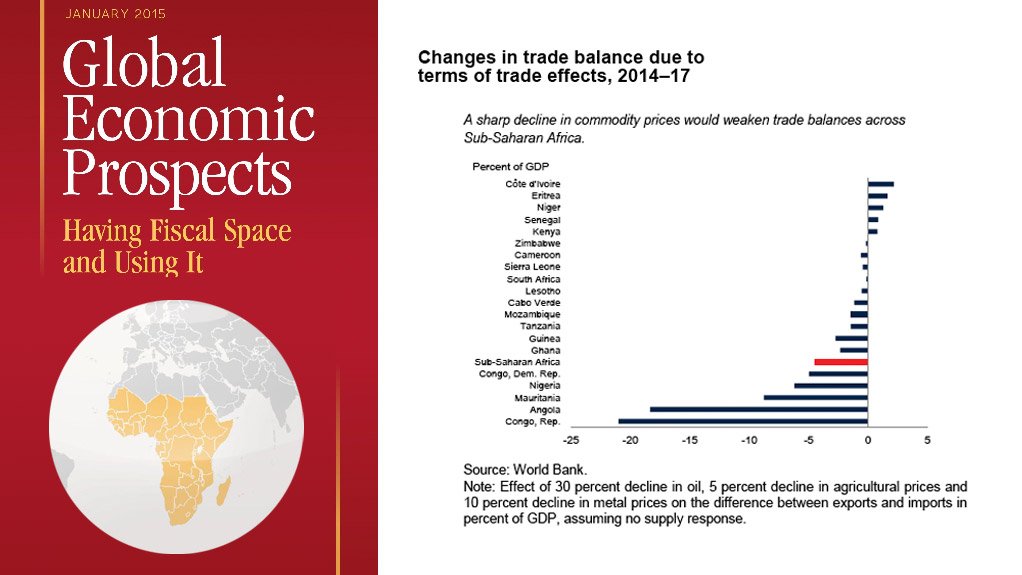

The trade balance in most African countries, including South Africa, would deteriorate under a scenario where the price of metals (aluminum, copper, gold, iron-ore, and silver) was 10% lower than the current baseline and where the price of agricultural commodities (cocoa, coffee, tea, cotton and tobacco) and crude oil were 5% and 30% weaker respectively.

“Countries where metals, agricultural products, or oil represent a large share of total exports see their terms of trade deteriorate sharply. A sharper-than-expected and sustained decline in the price of oil from the baseline would, on the whole, adversely affect the sub-Saharan Africa region, even though non-oil importers would gain.”

However, the steep decline in oil prices since the second half of 2014 could significantly reduce inflationary pressures and improve current account and fiscal balances in oil-importing developing countries such as South Africa.

World Bank Group president Jim Yong Kim argued that, given the uncertain economic environment, developing countries should deploy their resources to support social programmes with “a laser-like focus on the poor”, while undertaking structural reforms that invest in people.

“It’s also critical for countries to remove any unnecessary roadblocks for private sector investment. The private sector is by far the greatest source of jobs and that can lift hundreds of millions of people out of poverty,” Kim added.

The GEP argues further than governments in sub-Saharan Africa should pursue policies that preserve economic and financial stability. “The basic need is to strengthen fiscal positions and restore fiscal buffers to increase resilience against exogenous shocks.”

Large fiscal and current account deficits persist in Ghana, Kenya and South Africa, with South Africa seen to be especially vulnerable to potential capital outflows, owing to its reliance on portfolio investment.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation