Aspen full-year revenue, operating profit up

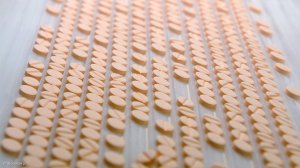

JSE-listed Aspen Pharmacare on Wednesday reported gross revenue of R31.4-billion for the year ended June 30, up 51% year-on-year, while operating profit increased 47% to R7.4-billion, driven largely by the group’s international business segment.

Aspen also reported a 29% increase in headline earnings per share (HEPS) to 1 016.3c, and a 42% increase in earnings a share to 1 097.9c.

Normalised headline earnings were up 27% to R4.9-billion and normalised HEPS also advanced 27% to 1 064c.

The company noted that, during the period under review, its international business advanced its revenue by 242% to R12.7-billion, and increased earnings before interest, taxes and amortisation (Ebita) by 144% to R3.6-billion.

Aspen said its international business gained the most from the significant transactions completed by the company during the financial year and contributed 40% of group gross revenue and 47% of group Ebita.

The division’s performance was also boosted by positive organic growth from the pre-existing global brands portfolio.

Meanwhile, Aspen’s South African business increased its revenue by 1% to R7.4-billion during the period under review.

The South African consumer division performed well, particularly as there had been diminishing consumer spending, Aspen said, noting that this division’s revenue had increased 12% to R1.3-billion through organic growth and the bolstering of the infant nutritional offering following completion of the transaction with Nestlé.

However, in the public sector, revenue contracted owing to a combination of lower antiretroviral (ARV) prices under the most recent tender award, sharply lower ARV volumes in the second half of the financial year, as the Department of Health (DoH) amended its procurement plans, and a decline in revenue from other public sector tenders.

The Ebita of the South African business was also unfavourably affected by the weakening of the rand, which added to the cost of goods.

Further, the single exit price increase of 5.82% granted by the DoH, which was implemented in March 2014, had proven insufficient to counteract the currency weakness and wage and energy cost inflation, Aspen said.

“These input pricing pressures, together with the negative effect of the lower value and volumes under the ARV tender were influential in an 8% reduction in Ebita of the South African business to R1.8-billion,” the company stated.

Meanwhile, in sub-Saharan Africa, solid organic growth by all parts of the business supported an increase in gross revenue of 32% to R2.7-billion and a gain in Ebita of 32% to R334-million.

Further, during the year under review, revenue in the Asia-Pacific region increased 12% to R8.5-billion, assisted by a full year of contribution from the pharmaceutical and infant nutritional products acquired in the prior year, good performances from the recently established companies in South-East Asia and a favourable relative exchange rate.

Borrowings, net of cash, increased by R18.7-billion over the year to R29.8-billion.

The company further noted that, during the 2015 financial year, progress should be achieved in respect of the multiple initiatives flowing from the significant transactions recently completed.

“The benefits of these transactions was reflected in the second-half performance of the past year and 2015 will be the first full year of operation for a number of newly established business units. Performance will [also] be influenced by organic growth achieved and reductions arising from disposals,” Aspen said.

Aspen declared a capital distribution of 188c a share.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation