SA’s plastics industry releases latest plastics production and recycling stats

This article has been supplied as a media statement and is not written by Creamer Media. It may be available only for a limited time on this website.

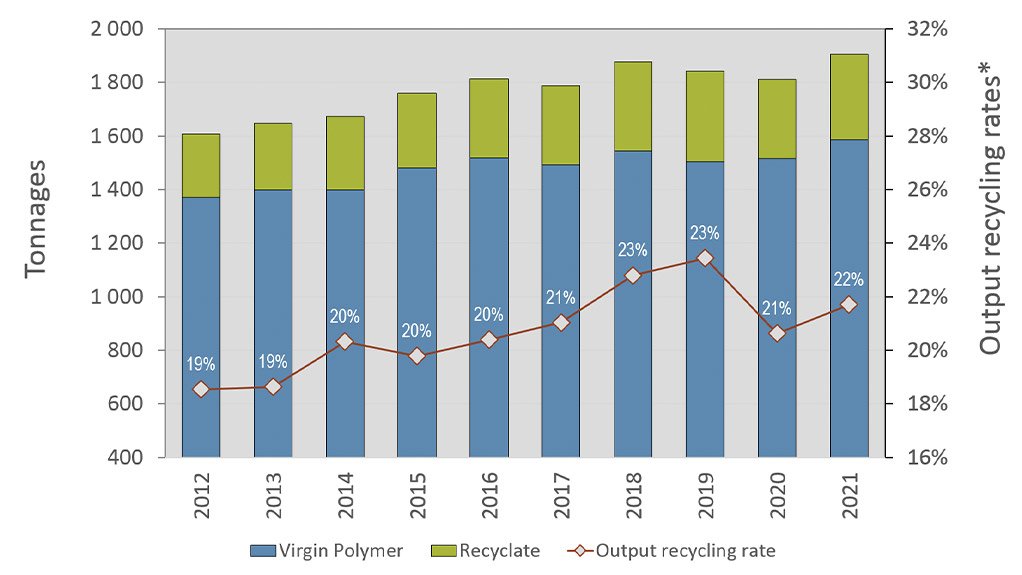

South Africa's plastics manufacturing and recycling industries grew by 4.7% last year, indicating a welcome recovery from the devastation caused by the Covid pandemic. Plastics SA Executive Director Anton Hanekom announced the latest production and recycling figures for the fiscal year ending December 2021, revealing that 1 904 924 tons of polymer were converted into new plastics products this year.

“This is the total amount of polymers produced locally, net imported polymers and recycled polymers sold locally to converters. Locally recycled polymer made up 21.7% of virgin consumption – up from 20.6% in 2020. This growth is consistent with the country’s 4.9% growth in GDP during the same period,” Hanekom says.

The polymer consumption in South Africa is calculated using both locally produced virgin tonnages and imported/exported polymers as recorded by the South African Revenue Services (SARS). Plastics recyclers who sell their recyclate into the local market provide data on recycled polymer consumption. Domestic polymer consumption is limited to polymers that have been locally converted into plastics and semi-finished products.

Market Sectors

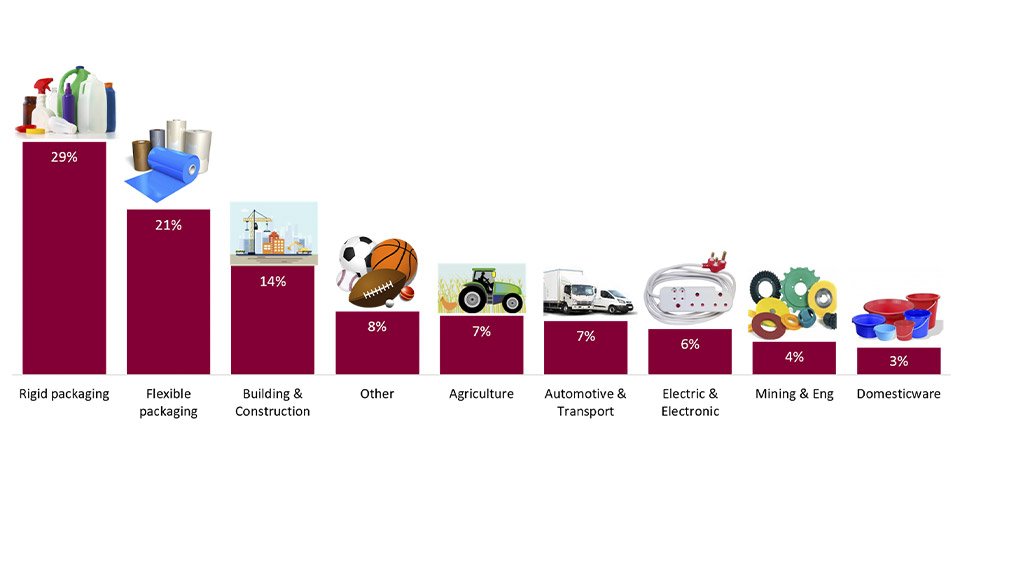

The packaging sector continues to make up half of the overall plastic polymer consumption in South Africa - 29 % for rigid packaging and 21 % for flexible packaging. This is followed by the building and construction sector as the third biggest market at 14 %.

"South Africa is not a packaging powerhouse – it is more the country’s weakness in the non‑packaging sector that should be highlighted. Despite the fact that the poor exchange rate and logistical challenges encountered in 2021 provided a much-needed boost to certain non-packaging related markets, these sectors are lagging behind the rest of the world. The demand for rotationally moulded water tanks peaked in 2019 and 2020, but we saw a decline last year. Agriculture and automotive/transportation applications now only make up 7% of the domestic market. However, as a direct result of local sourcing by Original Equipment Manufacturers (OEMs) and brand owners, there has been a slight increase in mining, engineering, and electric applications in their respective market sectors,” Anton reported.

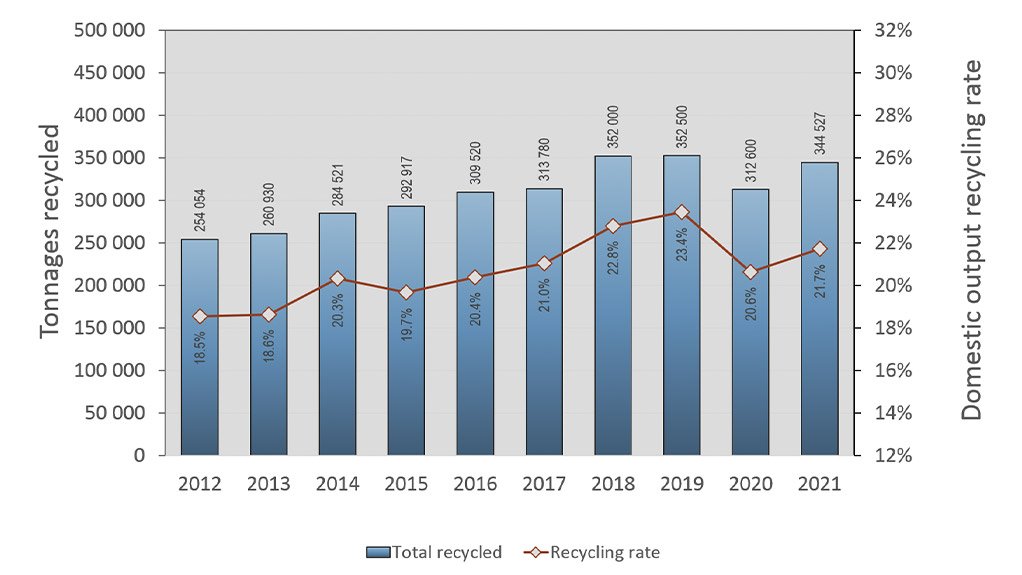

Plastics Recycling

South Africa recycled 344 527 tons of plastics during 2021 - representing a 10% increase over previous years. Although the industry has welcomed this growth, Anton stressed that much more needs to be done to support local recyclers and develop the industry to its full potential.

“In order for recycling to be effective, certain principles must be in place: products must be designed for recycling; the necessary systems must be in place to collect recyclable waste from the solid waste stream as early as possible; specifications must be in place for incoming recyclable waste in the sense that standards must be developed and adhered to for the recycling processes and subsequent recyclate; and environmental claims must be substantiated. While plastics collection and recycling have improved slightly, we are still not back to pre-Covid year levels recorded in 2019. Recyclers, like the rest of the country's manufacturing sector, were negatively impacted by economic challenges caused by load shedding and rising transportation and energy costs. Although still considerably less than virgin polymers, recycling still consumes a lot of energy. To ensure economic quantities, recyclables must also be transported to reprocessing plants," Anton explains.

Job creation

South Africa's unemployment rate reached a new high of 35.3% in the fourth quarter of 2021, with more than 500,000 jobs lost at the time. The manufacturing and construction industries were particularly hard hit, and unfortunately the plastics industry did not escape this trend.

"Although our calculations show that approximately 57 400 informal jobs (e.g., waste pickers and employees of smaller entrepreneurial collectors) were retained in the collection industry this year, formal employment in plastics recycling slipped by 11% to 5 533 formal jobs. Females account for 23% of the workforce and are preferred for more detailed jobs such as waste sorting. The majority of the functions, however, require physically stronger male workers due to the physical nature of their work. A small number of contract workers (4% of the total) are hired on an as-needed basis to sort incoming recyclable waste during peak periods. This figure has dropped yet again as businesses reduce the number of jobs and instead buy sorted, cleaner waste to cut operational costs," Anton reported.

End-markets for recycled material

Since 2012, South Africa’s recyclate production has increased by 36%. As a result, the average percentage of recycled content in new products has risen from 14.8% in 2012 to 16.7% in 2021. Various industry initiatives, individual company pledges and the ongoing efforts by recyclers are encouraging the use of recycled plastics in a variety of industries.

New end-markets for recycled plastics is critical to ensure the industry’s longterm viability. Plastics converters, who are the primary clients of recyclers, were severely strained as the overall economic climate deteriorated in 2021. Although recyclate has a market in almost every local market sector, recyclers have had to work harder than ever before to find sustainable markets for their materials. Despite operational challenges, only 7.7% of our recyclate was exported as raw material to Asian and SADC plastics converters

Conclusion

Plastics provide numerous societal benefits: they are used to create a safer, more convenient world; reduce food waste; contribute to energy-efficient buildings, allow for significant fuel savings in all modes of transportation, and can even save our lives. Plastics are critical to innovation and lowering energy demand while lowering greenhouse gas emissions.

There is no doubt, however, that we are at a point in history when society’s relationship with plastics is changing. The plastics industry, government and society as a whole all want the same thing: to reduce plastic pollution and leave the environment in a better state for future generations. Domestic waste management has entered the public consciousness, and many industries and consumers share a desire to reduce waste and prevent waste going to landfill, leaking into the environment, or being shipped offshore.

The plastics industry is working hard to ensure that plastics remain sustainable and have a positive impact on people and the environment. We are doing this by striving to transform the traditional linear economy - in which plastics are typically disposed of at the end of their service life, into a plastics circular economy where plastics remain in circulation for longer periods of time and are reused and recycled at the end of their life span.

"Considering the greater context of global events and local developments affecting the industry, we believe the 2021 results are satisfactory and in line with our expectations. We are aware of our shortcomings and where additional work is required. However, just as birds sing after a storm, we would like to express our heartfelt gratitude and appreciation to every company, individual employee, partner, and supplier who assisted us in weathering a very difficult and tumultuous period in our history. As an industry, we will continue to work harder, embrace innovation, and aim higher in order to meet our own and society's expectations," Anton concludes.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation