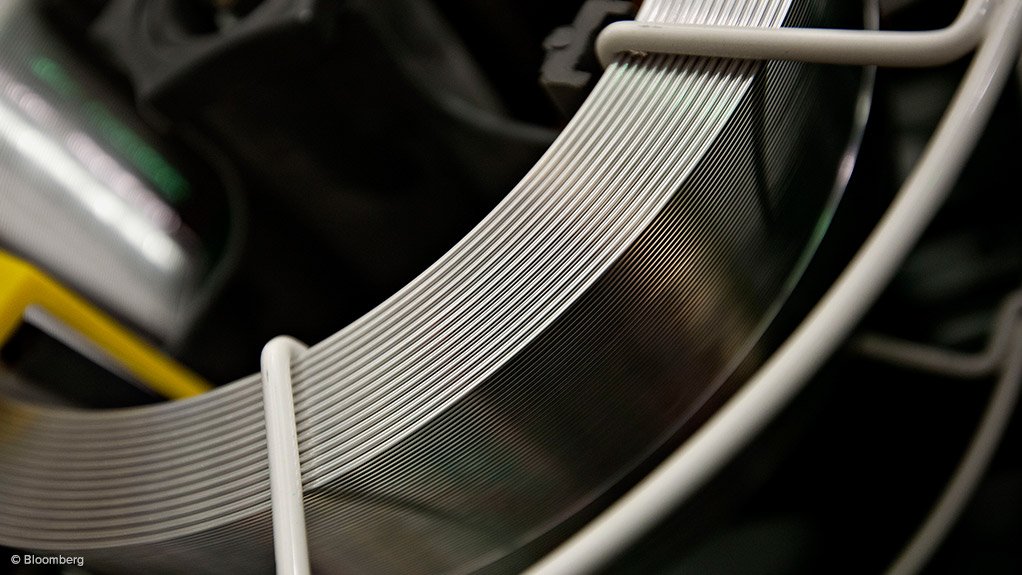

Aluminium market deficit on the cards this year; price reacts to Chinese curtailments – BofAML

VANCOUVER (miningweekly.com) – The Chinese government has so far this year ordered 4.3-million tonnes of aluminium capacity closures at smelters in Inner Mongolia, Shandong and Xinjiang, pointing to the potential for a global aluminium market deficit to emerge before year-end, the latest analysis from Bank of America Merrill Lynch (BofAML) Global Research has found.

After being range-bound between February and July, aluminium prices have rallied on a series of announced production curtailments in China.

Given that the rally was driven by dynamics in the Asian nation, it is perhaps not surprising that trading activity on the Shanghai Futures Exchange (SHFE) has picked up markedly, reflecting trends in steel and iron-ore, where aggressive positioning often led to a spike in speculative activity.

“To that point, new longs have been the dominant aluminium position on SHFE, in contrast to the London Metals Exchange, where traders have been more cautious. Linked to that, trading volumes and realised volatility on SHFE have risen sharply. This is a risk because smelter closures have so far not fed fully into the physical market and China's authorities tend to dampen unusual trading activity on the country's commodity exchanges,” the global commodity research team’s studies have revealed.

The analysts believe that China's authorities have been motivated to act by a series of recent trade cases, concerns over the environment and illegal capacity/industry profitability.

The US launched a trade case with the World Trade Organisation against China's aluminium industry in January. While this case has been pending, China's authorities have started tackling pollution, asking smelters to reduce output in 26 plus 2 cities around Beijing during winter.

The country's government has also shown disquiet about illegal capacity that has been built especially by privately owned smelters. These investments contributed heavily to overcapacities and a lack of industry profitability.

According to BofAML, of those producers affected, Hongqiao, whose stock has been suspended from trading since March, has borne the bulk of the closures at a nominal 2.7-million tonnes, followed by East Hope, in Xinjiang, at 800 000 t and Xinfa, in Shandong at 530 000 t.

“Tallying up announced and implemented closures, we estimate that China's aluminium production will come in at 34.9-million tonnes this year, low enough to push the global market into deficit, a key reason we maintain a Q4 price forecast of $2 150/t [or 98c/lb].

“Having said that, and looking further out, there is strong anecdotal evidence that operators in the world excluding China sector are picking up the baton in boosting output, making sustained rallies difficult in the medium-term,” BofAML stated.

The aluminium price has risen 22.5% since the start of the year to trade at 2 062/t on Friday.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation